Over the past year, mortgage rates have fallen more than a full percentage point. This is a great driver for homeownership, as today’s low rates provide consumers with some significant benefits. Here’s a look at three of them:Refinance: If you already own a home, you may want to decide if you’re going to refinance. It’s one way to lock in a … Read More

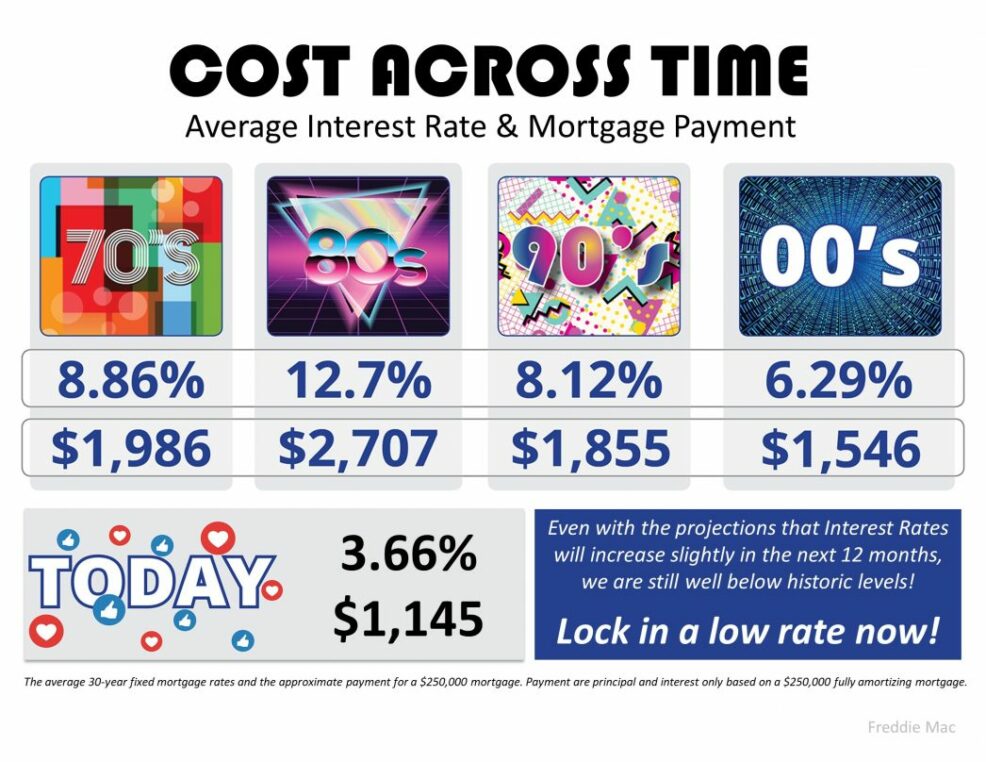

The Cost Across Time [INFOGRAPHIC]

Some Highlights: With interest rates around 3.66%, now is a great time to look back at where they’ve been over the past few decades. Comparatively, they’re pretty low! According to Freddie Mac, rates are projected to increase to 3.9% by this time next year. The impact your interest rate has on your monthly mortgage payment is significant. An increase of just $20 … Read More

How Long Can This Economic Recovery Last?

The economy is currently experiencing the longest recovery in our nation’s history. The stock market has hit record highs, while unemployment rates are at record lows. Home price appreciation is beginning to reaccelerate. This begs the question: How long can this economic recovery last? The Wall Street Journal (WSJ) Survey of Economists recently called for an economic slowdown (recession) in the near future. The most … Read More

This is Not 2008 All Over Again: The Mortgage Lending Factor

Some are afraid the real estate market may be looking a lot like it did prior to the housing crash in 2008. One of the factors they’re pointing at is the availability of mortgage money. Recent articles about the availability of low-down payment loans and down payment assistance programs are causing concern that we’re returning to the bad habits of … Read More

75 Years of VA Home Loan Benefits

Today, on Veterans Day, we salute those who have served our country in war or peace, and we thank them for their sacrifice. This year marks the 75th anniversary of VA Home Loan Benefit offerings through the Servicemen’s Readjustment Act, also known as the GI Bill. Since 1944, this law has created opportunities for those who have served our country, ranging from vocational … Read More

Forget the Price of the Home. The Cost is What Matters.

Home buying activity (demand) is up, and the number of available listings (supply) is down. When demand outpaces supply, prices appreciate. That’s why firms are beginning to increase their projections for home price appreciation going forward. As an example, CoreLogic increased their 12-month projection for home values from 4.5% to 5.6% over the last few months. The reacceleration of home values will … Read More

How to Determine If You Can Afford to Buy a Home

The gap between the increase in personal income and residential real estate prices has been used to defend the concept that we are experiencing an affordability crisis in housing today. It is true that home prices and wages are two key elements in any affordability equation. There is, however, an extremely important third component to that equation: mortgage interest rates. Mortgage … Read More

Buying a home can be SCARY…Until you know the FACTS [INFOGRAPHIC]

Some Highlights: Many potential homebuyers believe they need a 20% down payment and a 780 FICO® score to qualify to buy a home. This stops many people from even trying to jump into homeownership! Here are some facts to help take the fear out of the process: 71% of buyers who purchased homes have put down less than 20%. 78.1% … Read More

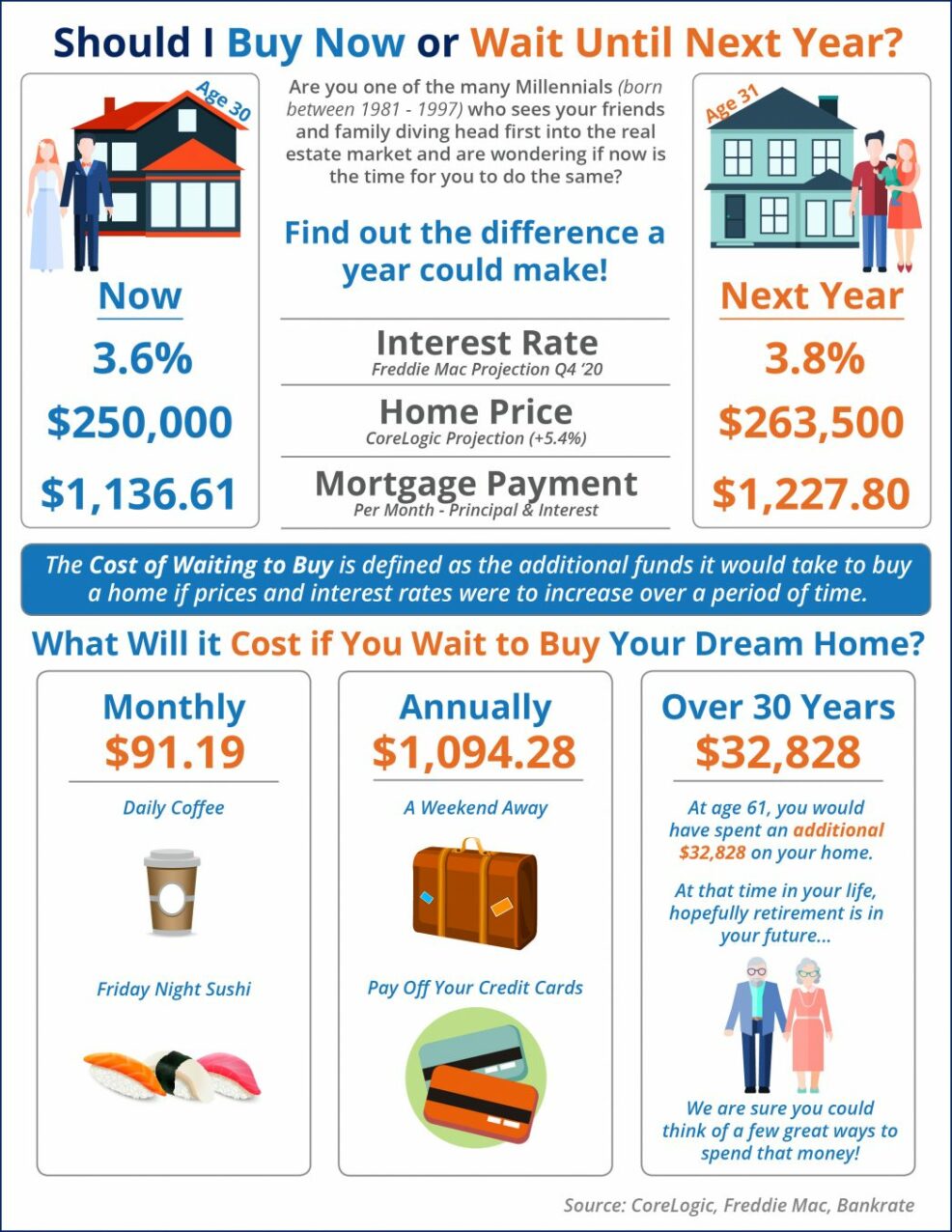

What Is the Cost of Waiting Until Next Year to Buy? [INFOGRAPHIC]

Some Highlights: The “cost of waiting to buy” is defined as the additional funds necessary to buy a home if prices and interest rates were to increase over a period of time. Freddie Mac forecasts interest rates will rise to 3.8% by Q4 2020. CoreLogic predicts home prices will appreciate by 5.4% over the next 12 months. If you’re ready and willing to buy … Read More