According to the latest FreddieMac Quarterly Forecast, mortgage interest rates have fallen to historically low levels this spring and they’re projected to remain low. This means there’s a huge incentive for buyers who are ready to purchase. And homeowners looking for eager buyers can take advantage of this opportune time to sell as well. There’s a very positive outlook on interest … Read More

Three Reasons Homebuyers Are Ready to Purchase This Year

A recent survey by Lending Tree tapped into behaviors of over 1,000 prospective buyers. The results indicated 53% of all homebuyers are more likely to buy a home in the next year, even amid the current health crisis. The survey further revealed why, naming several reasons buyers are more likely to move this year (see graph below):Let’s break down why these are a few of the key … Read More

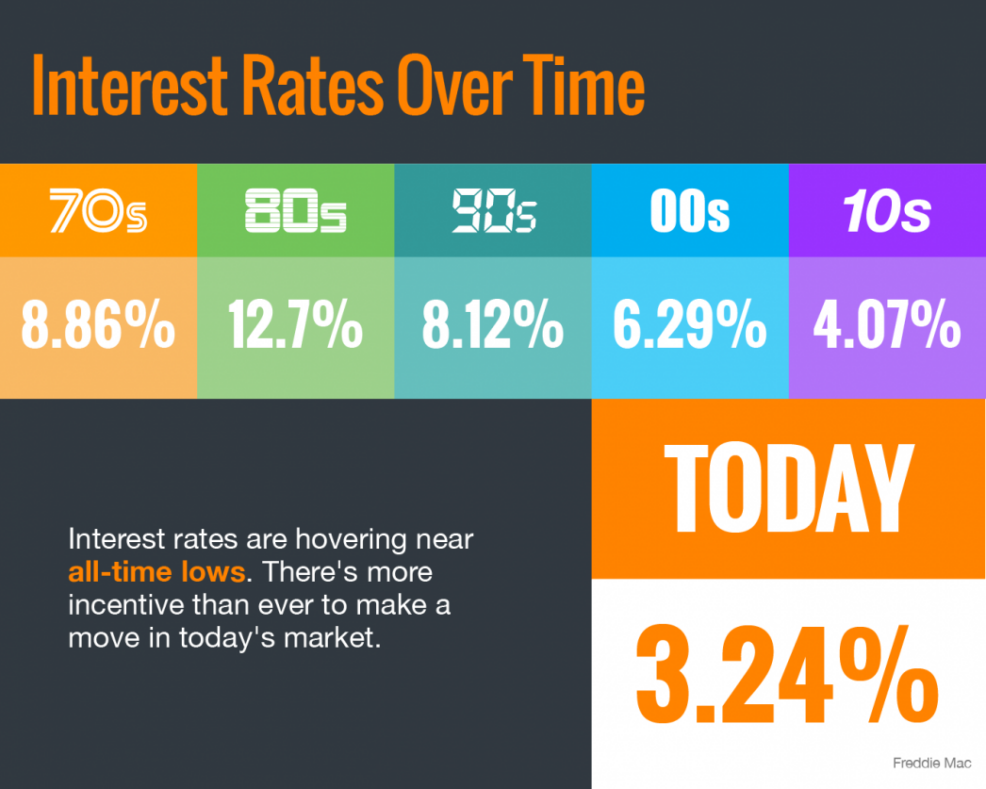

Interest Rates Hover Near Historic All-Time Lows [INFOGRAPHIC]

Some Highlights Mortgage interest rates have dropped considerably this spring and are hovering at a historically low level. Locking in at a low rate today could save you thousands of dollars over the lifetime of your home loan. Let’s connect to determine the best way to position yourself for a move in today’s market.

Buying a Home Right Now: Easy? No. Smart? Yes.

Through all the volatility in the economy right now, some have put their search for a home on hold, yet others have not. According to ShowingTime, the real estate industry’s leading showing management technology provider, buyers have started to reappear over the last several weeks. In the latest report, they revealed: “The March ShowingTime Showing Index® recorded the first nationwide drop in … Read More

Is Now a Good Time to Refinance My Home?

With interest rates hitting all-time lows over the past few weeks, many homeowners are opting to refinance. To decide if refinancing your home is the best option for you and your family, start by asking yourself these questions: Why do you want to refinance? There are many reasons to refinance, but here are three of the most common ones: 1. Lower Your … Read More

Yes, You Can Still Afford a Home

The residential real estate market has come roaring out of the gates in 2020. Compared to this time last year, the number of buyers looking for a home is up 20%, and the number of home sales is up almost 10%. The increase in purchasing activity has caused home price appreciation to begin reaccelerating. Many analysts have boosted their projections for price … Read More

Impact of the Coronavirus on the U.S. Housing Market

The Coronavirus (COVID-19) has caused massive global uncertainty, including a U.S. stock market correction no one could have seen coming. While much of the news has been about the effect on various markets, let’s also acknowledge the true impact it continues to have on lives and families around the world. With all this uncertainty, how do you make powerful and confident decisions … Read More

How Interest Rates Can Impact Your Monthly Housing Payments

Spring is right around the corner, so flowers are starting to bloom, and many potential homebuyers are getting ready to step into the market. If you’re thinking of buying this season, here’s how mortgage interest rates are working in your favor. Freddie Mac explains: “If you’re in the market to buy a home, today’s average mortgage rates are something to celebrate … Read More

Thinking of Selling? Now May Be the Time.

The housing market has started off much stronger this year than it did last year. Lower mortgage interest rates have been a driving factor in that change. The average 30-year rate in 2019, according to Freddie Mac, was 3.94%. Today that rate is closer to 3.5%. The Census Bureau also just reported the highest homeownership rate since 2014 for people under 35. This is evidence that owning their own home … Read More

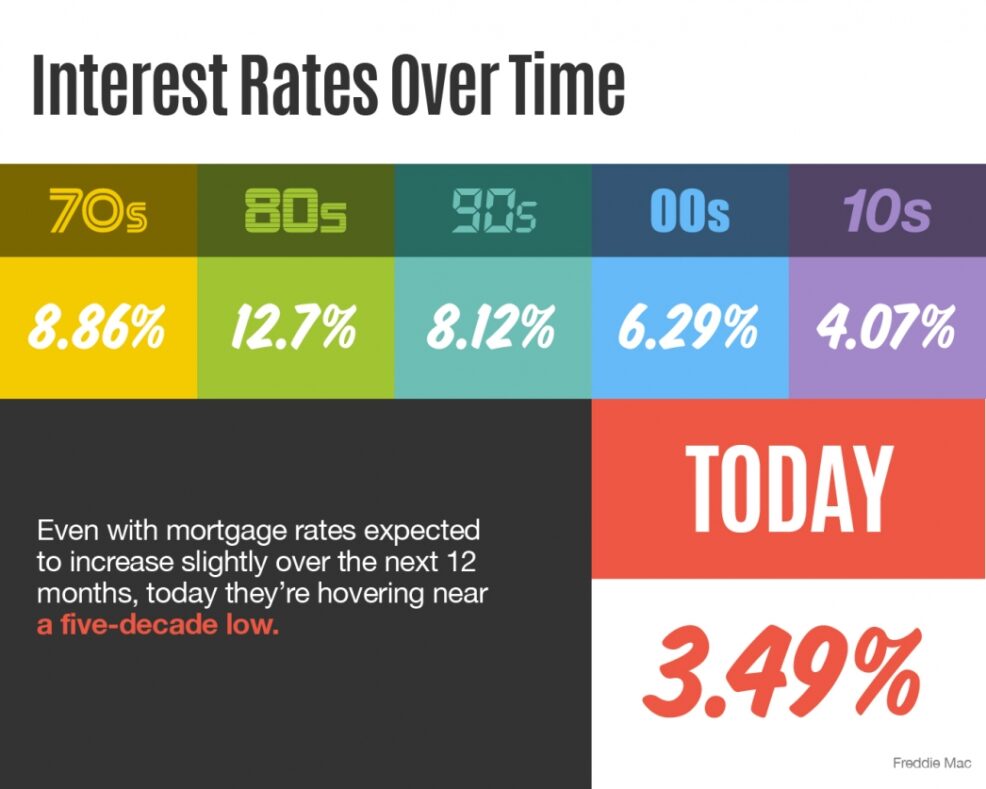

Interest Rates Over Time [INFOGRAPHIC]

Some Highlights: With interest rates hovering at near historic lows, now is a great time to look back at where they’ve been, and how much they’ve changed over time. According to Freddie Mac, mortgage interest rates are currently hovering near a five-decade low. The impact your interest rate has on your monthly mortgage payment is significant. An increase of just $20 dollars … Read More