Key Takeaways

-

Market Dynamics: The Austin housing market is currently experiencing a shift with more homes listed for sale than in the past 13 years. This has led to increased inventory and a decrease in median sales prices.

-

Impact of Interest Rates: The rapid rise in interest rates has significantly slowed buyer demand. Sellers may need to adjust their expectations as homes are selling closer to their list prices rather than above.

-

Future Outlook: There are differing opinions on the future direction of the market. Some expect a rebound in buyer demand if interest rates decrease, while others predict potential further declines in prices.

-

Seller Strategy: Sellers are advised to carefully consider their pricing strategy and motivations. Flexibility in pricing and readiness to negotiate may be key to successfully selling a property in the current market.

The Austin real estate market is currently facing challenging times, marked by significant shifts that spell more BAD NEWS for Austin housing market. From rising interest rates to an unprecedented surge in housing inventory, these factors are reshaping the dynamics of Austin’s real estate sector. This article delves into the critical aspects impacting the market, providing insights into what these developments mean.

Challenges Facing Austin’s Real Estate Sector

Austin’s real estate sector is grappling with several unprecedented challenges. A sudden surge in housing inventory, unseen in over a decade, has created a surplus that has dampened median prices and intensified competition among sellers. Economic uncertainties and fluctuating interest rates have added to the complexity, posing risks for both buyers and sellers. The market dynamics have shifted, making it difficult for sellers to close deals and requiring more strategic pricing and marketing approaches.

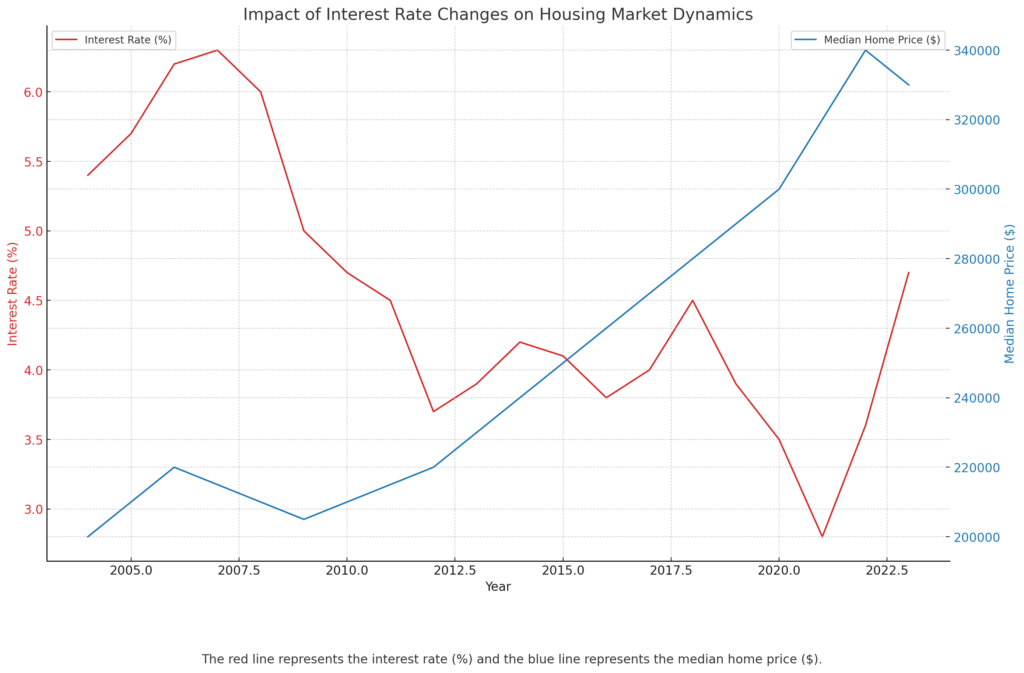

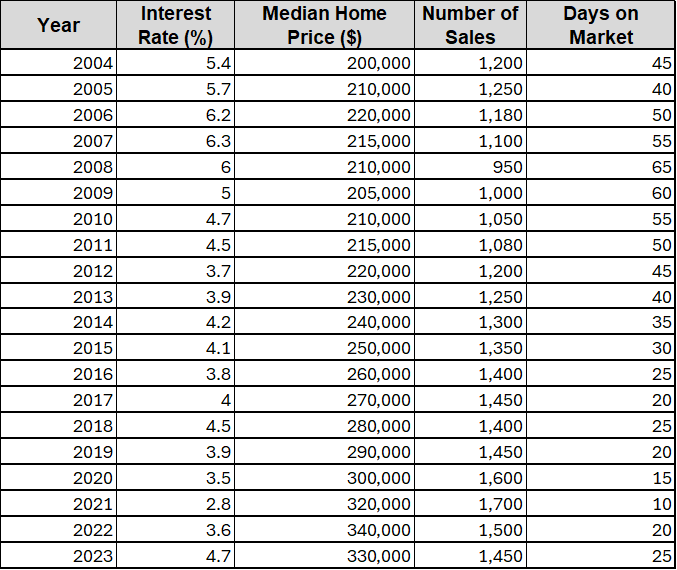

Impact of Rising Interest Rates on Austin Homes

The recent rise in interest rates has had a profound impact on Austin’s housing market dynamics. With rates climbing to historic highs, the cost of borrowing has escalated, reducing affordability and dampening buyer demand. This shift has led to a decrease in closed sales across the region as potential buyers rethink their purchasing decisions amidst higher costs. The higher interest rates have also made it more difficult for first-time homebuyers to enter the market, further reducing the pool of potential buyers.

Moreover, higher interest rates have prompted sellers to reassess their pricing strategies, often resulting in homes selling closer to their listed prices. Negotiations have become more commonplace, reflecting a cautious approach from both buyers and sellers navigating this new economic reality. Sellers must be prepared to adjust their expectations and be flexible with their pricing to close deals in this challenging environment.

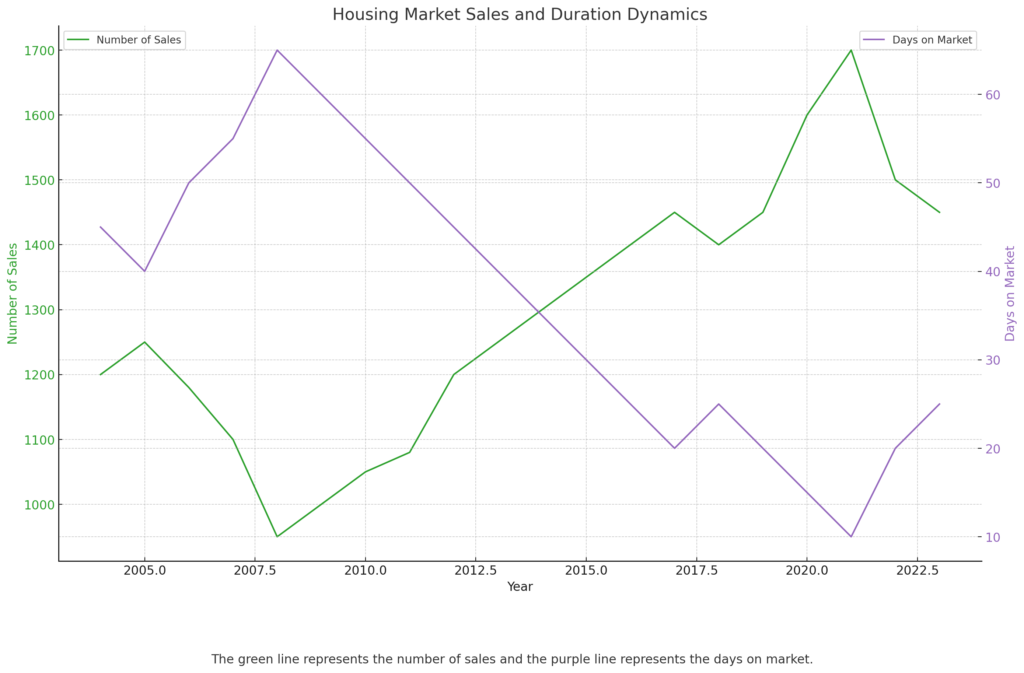

Analysis of Current Inventory Levels in Austin

Austin’s current real estate inventory levels depict a market flooded with homes for sale, a scenario unseen in over a decade. This surplus has significantly altered buyer-seller dynamics, favoring buyers who now have more options but remain cautious due to economic uncertainties and higher borrowing costs. Sellers, facing increased competition and longer days on the market, must strategically price their properties to attract serious offers. The increased inventory levels have also led to a more balanced market, where buyers have more negotiating power.

Understanding these inventory trends is crucial for stakeholders navigating the market’s complexities. Strategic pricing, enhanced marketing efforts, and awareness of regional variations are essential for making informed decisions in this evolving landscape. Sellers must be aware of the competition and price their homes competitively to attract buyers, while buyers can take advantage of the increased inventory to find the best deals.

Price Trends and Their Implications in Austin

Austin’s housing market has witnessed notable shifts in price trends influenced by increased inventory, rising interest rates, and economic uncertainties. These trends have translated into a market where median prices are adjusting to reflect supply-demand dynamics and negotiation pressures between buyers and sellers. The increased inventory and higher interest rates have put downward pressure on prices, making it more challenging for sellers to get their asking price.

For buyers, this presents an opportunity to negotiate closer to the list price and potentially secure favorable deals in a cooling market. Sellers, meanwhile, must recalibrate pricing expectations and leverage market insights to optimize their listing strategies. Monitoring these price fluctuations is crucial for anyone involved in Austin’s real estate market to make informed decisions. Sellers must be prepared to adjust their pricing to reflect market conditions, while buyers can take advantage of the lower prices to find good deals.

Expert Opinions on Austin’s Housing Market Outlook

Experts offer varying perspectives on Austin’s housing market outlook, navigating uncertainties with cautious optimism. Some anticipate market stabilization as interest rates potentially ease, while others warn of continued volatility and potential price corrections. Understanding these diverse viewpoints provides valuable insights for stakeholders planning their strategies amidst the evolving real estate landscape in Austin. The experts’ opinions highlight the need for flexibility and adaptability in the face of an uncertain market.

Experts emphasize the importance of staying informed about market trends and economic indicators. By keeping a close eye on these factors, buyers and sellers can make more informed decisions and better navigate the complexities of the Austin housing market. The diverse expert opinions underscore the importance of being prepared for various scenarios and remaining adaptable to changing market conditions.

Factors Contributing to Reduced Buyer Interest in Austin

Several factors contribute to the reduced buyer interest in Austin’s housing market. High interest rates have made borrowing more expensive, reducing affordability for many potential buyers. Economic uncertainties and concerns about job stability have also made buyers more cautious, leading to a decrease in the urgency to purchase homes. Additionally, the increased inventory levels have given buyers more options, allowing them to take their time and be more selective in their purchases.

The rising cost of living in Austin, including property taxes and home prices, has also played a role in reducing buyer interest. Many potential buyers are finding it difficult to afford homes in the area, leading them to look elsewhere or delay their purchasing plans. These factors, combined with the broader economic uncertainties, have created a challenging environment for the housing market, with reduced buyer demand and increased competition among sellers.

Comparative Analysis of Austin’s Housing Market Pre and Post-Pandemic

A comparative analysis of Austin’s housing market pre and post-pandemic reveals significant changes in market dynamics. Before the pandemic, Austin’s real estate market was characterized by steady growth, with increasing home prices and strong buyer demand. The low interest rates and robust economic conditions contributed to a vibrant market, with homes selling quickly and often above the list price.

The pre-pandemic period was marked by a seller’s market, with limited inventory and high competition among buyers. In contrast, the post-pandemic period has seen significant shifts, with increased inventory levels, rising interest rates, and economic uncertainties. The rapid rise in home prices during the pandemic, driven by unprecedented buyer demand and low interest rates, has now given way to a more balanced market with increased inventory and reduced buyer interest. The post-pandemic period is characterized by longer days on the market, closer-to-list price negotiations, and a more cautious approach from both buyers and sellers. This comparative analysis highlights the profound impact of the pandemic on Austin’s housing market dynamics.

Strategic Recommendations for Austin Home Sellers

In the current challenging market conditions, Austin home sellers must adopt strategic approaches to attract buyers and close deals. Pricing the property competitively is crucial, considering the increased inventory and reduced buyer demand. Sellers should conduct thorough market analyses to understand the competition and set realistic pricing expectations. Additionally, enhancing the property’s appeal through staging, minor repairs, and effective marketing can make a significant difference in attracting potential buyers.

Flexibility and willingness to negotiate are also essential for sellers. Understanding the buyer’s perspective and being open to negotiations can help close deals in a competitive market. Sellers should also consider offering incentives, such as covering closing costs or offering home warranties, to attract buyers. By adopting these strategic approaches, Austin home sellers can navigate the challenging market conditions and successfully sell their properties.

Insights into Interest

NerdWallet: July Mortgage Rates Could Follow House Prices Downward

- Mortgage rates are gradually decreasing, with the 30-year fixed-rate mortgage dropping from 7.22% in May to 6.86% in June, due to cooling inflation. Potential rate cuts by the Federal Reserve might occur later in 2024.

Money.com: Current Mortgage Rates: Week of July 15 to July 19, 2024

- The average 30-year fixed-rate mortgage is 6.89%, and the 15-year fixed-rate mortgage is 6.17%. Rates dropped slightly following a lower-than-expected jobs report.

LendingTree: Mortgage Interest Rates Forecast for 2024: When Will Rates Go Down?

- Mortgage rates are predicted to gradually decrease in late 2024, potentially reaching 6% by year-end as inflation cools and the Federal Reserve considers rate cuts. High home prices and low housing supply continue to affect affordability.

Effects of Economic Uncertainty on Austin’s Real Estate Market

Economic uncertainty has had a profound impact on Austin’s real estate market, influencing buyer behavior and market dynamics. Concerns about job stability, inflation, and broader economic conditions have made buyers more cautious, leading to reduced demand and longer days on the market for sellers. This uncertainty has also affected sellers, who must now navigate a more competitive market and adjust their pricing strategies to attract buyers.

For buyers, economic uncertainty has led to a more deliberate approach to purchasing decisions. Potential buyers are taking their time to evaluate the market and are more selective in their choices. Sellers, on the other hand, must be prepared to adjust their expectations and remain flexible in negotiations. Understanding the effects of economic uncertainty is crucial for both buyers and sellers to navigate the current market conditions effectively.

Regional Variations in Austin’s Housing Price Corrections

Regional variations in Austin’s housing price corrections highlight the diverse impacts of market dynamics across different neighborhoods. Some areas have experienced significant price declines due to increased inventory and reduced buyer demand, while others have remained relatively stable. Understanding these regional variations is crucial for buyers and sellers to make informed decisions based on specific market conditions in their areas.

For sellers, being aware of regional price trends can help set realistic pricing expectations and develop effective marketing strategies. Buyers, on the other hand, can leverage this knowledge to identify areas with more favorable market conditions and negotiate better deals. By considering regional variations, stakeholders can navigate Austin’s housing market more effectively and make informed decisions that align with their goals.

Long-Term Projections for Austin’s Real Estate Landscape

Long-term projections for Austin’s real estate landscape suggest a cautious yet optimistic outlook. While current market conditions are challenging, experts believe that Austin’s strong economic fundamentals and continued population growth will support long-term stability and growth in the housing market. However, the timing and extent of this recovery will depend on various factors, including interest rate trends, economic conditions, and policy measures.

Buyers and sellers should stay informed about these long-term projections and be prepared to adapt their strategies as market conditions evolve. By taking a long-term perspective and remaining flexible, stakeholders can navigate the uncertainties and capitalize on opportunities in Austin’s real estate market. Understanding these projections can help make more informed decisions and develop strategies that align with long-term goals.

Policy Implications for Austin’s Housing Market Recovery

Policy measures will play a crucial role in shaping Austin’s housing market recovery. Government initiatives to address affordability, support economic stability, and manage interest rates will influence market dynamics and stakeholder decisions. Policies aimed at increasing housing supply, improving infrastructure, and providing financial assistance to home buyers can help stabilize the market and support long-term growth.

Stakeholders should stay informed about policy changes and their potential impacts on the housing market. By understanding policy implications, buyers and sellers can adapt their strategies and make more informed decisions. Policymakers, on the other hand, should consider the diverse needs of the market and implement measures that promote stability and growth in Austin’s real estate sector.

Final Thoughts

As Austin’s housing market navigates through challenging times, stakeholders must remain vigilant and adaptable to emerging trends and economic shifts. The surge in inventory and impact of rising interest rates are reshaping buyer-seller dynamics, influencing pricing strategies and market behaviors. Whether you’re a buyer looking for opportunities in a cooling market or a seller aiming to optimize your property’s value, navigating these complexities requires informed decision-making and strategic planning.

Keeping a pulse on market trends and expert insights will be essential for successfully navigating the evolving landscape of Austin’s real estate market. Someday more BAD NEWS for Austin housing market will become good news, and what is seen as bad may be an advantage from another viewpoint.

People Also Ask:

Why is Austin’s housing market going down?

Is the Austin real estate market overvalued?

Does Austin have a housing crisis?

Is Austin, TX a buyers or sellers market?

Is the housing market crashing in Austin in 2024?

Is it a bad time to buy a house in Austin?

Why are people leaving Austin?

Is Austin becoming unaffordable?

Is Austin still a good place to invest?

Why is Austin so expensive?

Are rents dropping in Austin?

Why are houses so cheap in Austin Texas?