Key Takeaways

- Recent Federal Reserve rate cuts might not significantly impact Austin’s housing market.

- New builds in Austin’s outskirts offer lower prices and interest rates than resales in central areas.

- High mortgage rates and seller expectations slow resale home sales in Austin.

- Buyers continue to hold out for price drops, while sellers remain firm on listing prices.

- Austin’s housing market stability makes a major collapse unlikely, even amid low transactions.

The Federal Reserve’s recent interest rate cuts sparked hope for revitalizing Austin’s housing market, but early signs indicate the changes may not offer the immediate impact that buyers, sellers, and industry experts are expecting. Even with slightly lower mortgage rates, buyer hesitation and high resale home prices in Austin create a unique scenario that calls into question whether lower mortgage rates alone can breathe new life into the market. This article dives into the intricacies of Austin’s housing market, comparing new construction options with resales and exploring whether current economic conditions and price expectations will align enough to spark significant growth in transactions. Low mortgage rates won’t save Austin’s housing market

Why Lower Interest Rates Might Not Revive Austin’s Housing Market

Austin’s housing market is distinct from other U.S. markets, where a reduction in the Federal Reserve’s interest rates often leads to increased buyer activity. However, in Austin, high home prices and limited resale options mean that simply reducing interest rates may not be enough to bridge the gap between buyer and seller expectations. While more affordable borrowing theoretically encourages spending, Austin’s higher-than-average home prices put the market out of reach for many potential buyers, even at lower mortgage rates.

In addition, buyers are wary of making significant investments in a market where high valuations persist, and many hold out for price reductions that may not materialize. As a result, transactions remain low despite interest rate cuts, with many experts predicting that sustained changes in the local economy or housing prices will be required to make the impact buyers are hoping for. For now, the low mortgage rate environment alone isn’t enough to close Austin’s transaction gap.

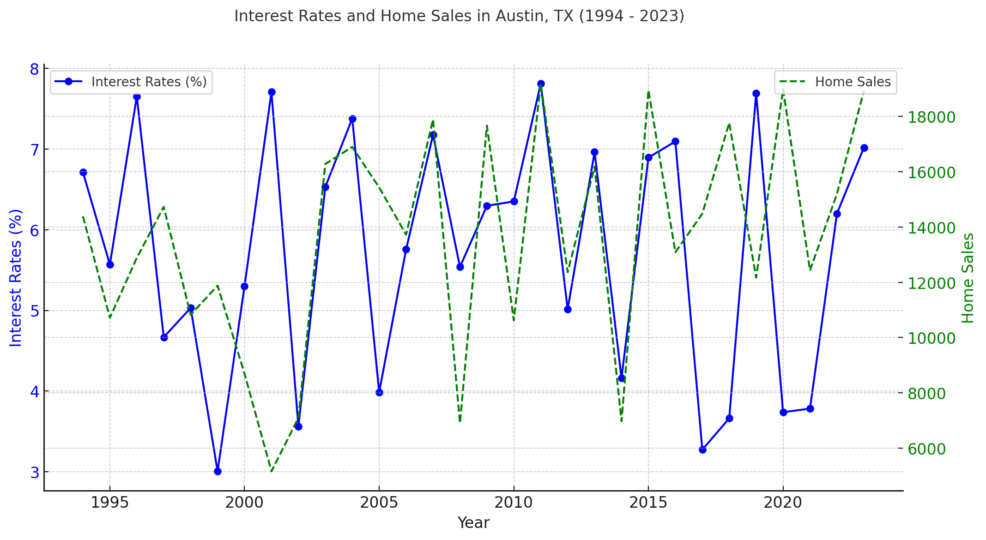

How Mortgage Rate Reductions Affect Home Sales in Austin

Interest rates and mortgage rates are closely connected, but the reduction in the Federal Reserve’s rates may not translate directly to mortgage rate drops that are substantial enough to drive new home purchases. Although many buyers hope for rates to decrease to the 5% range, recent economic shifts suggest that mortgage rates will likely hover higher, limiting their potential as a market motivator. Buyers in Austin may still face considerable challenges in accessing affordable mortgage rates that would make buying feasible or appealing, particularly compared to the rates available during the pandemic peak.

Moreover, new homebuilders who offer competitive mortgage rates continue to see more activity than resale markets, reflecting a significant shift in consumer behavior. If mortgage rates remain high, buyers could continue gravitating towards new builds, where rates and prices are comparatively lower. Ultimately, while rate cuts create hope, they may not directly correlate with substantial mortgage relief for Austin’s prospective homebuyers.

The Impact of Austin’s High Home Prices on Resale Transactions

Resale transactions in Austin have been sluggish, not only due to mortgage rates but also because of the high price tags attached to many existing homes. Sellers often remain firm on their listings, holding out for offers close to their asking prices rather than reducing them to reflect current demand. This mismatch in expectations has led to an extended market stagnation, with a considerable percentage of listings remaining unsold for over 120 days, and some even beyond 180 days.

These extended listing periods reflect a continued expectation gap. While buyers are seeking more affordable options, sellers are holding onto their higher prices, betting on a market rebound or simply waiting out for the right offer. Consequently, buyers considering resale options are often priced out or discouraged from entering the market at all, preferring to wait for potential price adjustments or alternative options in the form of new construction.

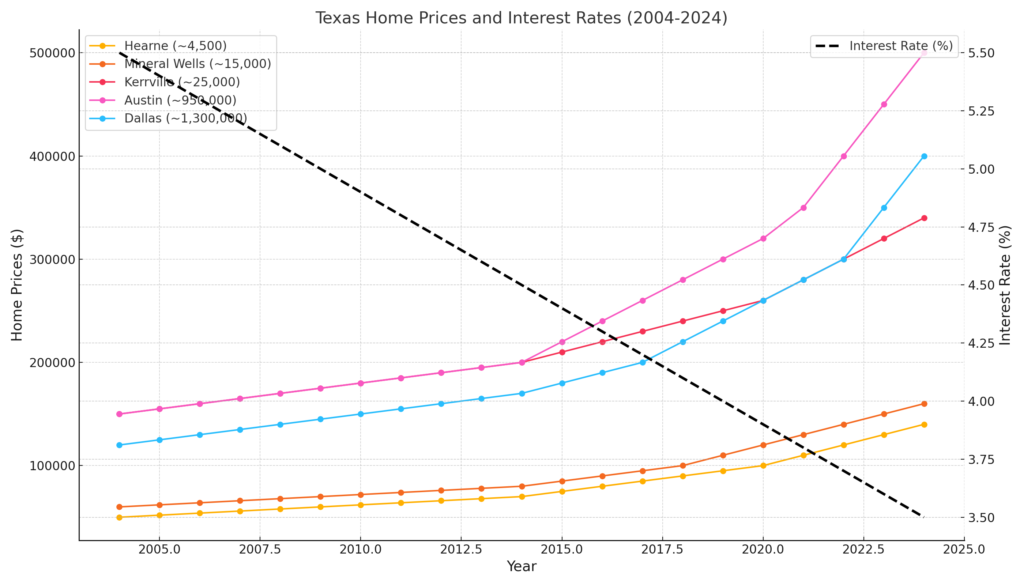

Home Prices and Interest Rates for 5 Texas Cities over 20 Years

| Year | Hearne (~4,500) | Mineral Wells (~15,000) | Kerrville (~25,000) | Austin (~950,000) | Dallas (~1,300,000) | Interest Rate (%) |

| 2004 | 50000 | 60000 | 150000 | 150000 | 120000 | 5.5 |

| 2005 | 52000 | 62000 | 155000 | 155000 | 125000 | 5.4 |

| 2006 | 54000 | 64000 | 160000 | 160000 | 130000 | 5.3 |

| 2007 | 56000 | 66000 | 165000 | 165000 | 135000 | 5.2 |

| 2008 | 58000 | 68000 | 170000 | 170000 | 140000 | 5.1 |

| 2009 | 60000 | 70000 | 175000 | 175000 | 145000 | 5 |

| 2010 | 62000 | 72000 | 180000 | 180000 | 150000 | 4.9 |

| 2011 | 64000 | 74000 | 185000 | 185000 | 155000 | 4.8 |

| 2012 | 66000 | 76000 | 190000 | 190000 | 160000 | 4.7 |

| 2013 | 68000 | 78000 | 195000 | 195000 | 165000 | 4.6 |

| 2014 | 70000 | 80000 | 200000 | 200000 | 170000 | 4.5 |

| 2015 | 75000 | 85000 | 210000 | 220000 | 180000 | 4.4 |

| 2016 | 80000 | 90000 | 220000 | 240000 | 190000 | 4.3 |

| 2017 | 85000 | 95000 | 230000 | 260000 | 200000 | 4.2 |

| 2018 | 90000 | 100000 | 240000 | 280000 | 220000 | 4.1 |

| 2019 | 95000 | 110000 | 250000 | 300000 | 240000 | 4 |

| 2020 | 100000 | 120000 | 260000 | 320000 | 260000 | 3.9 |

| 2021 | 110000 | 130000 | 280000 | 350000 | 280000 | 3.8 |

| 2022 | 120000 | 140000 | 300000 | 400000 | 300000 | 3.7 |

| 2023 | 130000 | 150000 | 320000 | 450000 | 350000 | 3.6 |

| 2024 | 140000 | 160000 | 340000 | 500000 | 400000 | 3.5 |

New Builds vs. Resales: The Diverging Paths of Austin’s Housing Market

Austin’s new construction market has followed a different trajectory than the resale sector, with new builds selling at a median price significantly lower than comparable resales. This affordability difference is especially evident in Austin’s suburbs, where more land availability allows builders to offer homes that attract buyers with competitive prices and promotional mortgage rates. In some cases, suburban new builds are up to $50,000 less than resale homes, drawing interest from buyers priced out of central Austin.

Contrastingly, new builds within the city command higher prices than their suburban counterparts, often exceeding resale home prices. In Austin’s urban core, new construction homes are priced over $100,000 higher than existing homes, adding a premium for proximity and amenities. This pricing disparity between urban and suburban new builds versus resales highlights the complexities of Austin’s market and the growing appeal of suburban new constructions for budget-conscious buyers.

Why Buyer Interest in New Builds is Higher Than Ever

Buyers in the Austin area are increasingly interested in new builds, thanks in part to builder incentives like lower interest rates and lower list prices. With resale properties often requiring buyers to pay more in interest and, in some cases, above-list prices, new constructions appear more attractive by comparison. These homes not only provide financial incentives but also allow buyers to enjoy modern features and customization options that existing homes may not offer.

The availability of these builder incentives means that new homes outside central Austin are often priced closer to the median price range, making them more accessible to the average buyer. As a result, many buyers prioritize new constructions over resale homes, particularly in suburbs like Buda and Kyle, where new builds make up a significant portion of the housing market. This shift in demand highlights the allure of lower-cost, newer properties, especially amid a slowing resale market.

Buyer and Seller Standstill: The Expectation Gap in Austin’s Resale Market

A clear expectation gap has emerged in Austin’s resale housing market. Buyers often hope for price reductions, holding out for the possibility of a market correction, while sellers, under no significant pressure to reduce prices, continue to wait for buyers who will meet their asking price. The relatively stable economic environment in Austin has empowered sellers to stand firm, contributing to prolonged listing times and reduced transaction volumes.

Many buyers, meanwhile, are cautious about paying premium prices, particularly when economic forecasts remain uncertain. Without pressures like property tax delinquency or impending foreclosure, sellers have little reason to drop their prices, making it difficult for buyers to negotiate deals that match their budget or price expectations. This standstill between buyers and sellers has prolonged market stagnation and delayed potential housing market corrections in Austin.

Further Reading

- NerdWallet’s Explanation of Fed Rate Cuts This article discusses the direct impacts of the Fed’s rate cuts on mortgage interest rates and overall buyer demand, emphasizing why these cuts might not immediately translate into a housing market boom. It also explores how lower rates could influence buying decisions, with some caution against expecting pre-pandemic rate levels.

- Investopedia’s Insights on Mortgage Market Dynamics Investopedia dives into how the Fed’s rate cuts indirectly affect mortgage rates, which are also influenced by the 10-year Treasury yield. This piece explores how anticipated rate cuts might boost home listings, INVESTOPEDIA the coming months.

- Fast Company’s Analysis of Fed Rate Cut Implications Fast Company offers a detailed look at the complexities of how the rate cut might benefit different housing market segments, especially INVESTOPEDIA scores that while lower rates could bring more buyers back, immediate relief may be limited by other economic factors.

The Pandemic’s Lasting Influence on Austin’s Housing Market

The COVID-19 pandemic reshaped Austin’s housing market, fueling an initial boom due to increased remote work and heightened demand for city-center properties. Prices soared, and the market witnessed a competitive frenzy where buyers had to bid well above asking prices to secure homes. These rapid changes set a precedent that influences today’s expectations, with sellers often anchored to the values established during that period.

Despite shifting economic conditions, the prices that buyers were once willing to pay linger as a benchmark, complicating the current landscape. Now, as economic realities shift, buyers are less inclined to compete for resale properties, contributing to the persistently slow transactions and an inflated price baseline that hasn’t aligned with post-pandemic market conditions.

The Role of Federal Reserve Rate Cuts in Austin’s Housing Market Dynamics

Federal Reserve rate cuts are a significant economic lever, often stimulating housing markets by making borrowing cheaper. However, Austin’s market response to the recent cuts is mixed. While lower interest rates generally incentivize borrowing, Austin’s high home prices and buyer uncertainty have limited the rate cuts’ influence on overall market dynamics. Many buyers remain hesitant, as even minor rate cuts haven’t reduced monthly payments to a level that justifies the substantial upfront cost of purchasing a home.

Additionally, with mortgage rates expected to stabilize in the high 5% range, the impact of Federal Reserve policy may be muted, affecting buyer behavior minimally. Rather than igniting a wave of new purchases, these rate cuts highlight the underlying challenges in Austin’s market, where affordability and price expectations are key determinants of buyer interest.

Why Austin’s Market is Unlikely to Collapse Despite Low Transactions

While Austin’s housing market has slowed, many experts suggest that a collapse is unlikely. The area’s economic stability and high-demand profile reduce the risk of a significant downturn, even if transactions remain low. Unlike markets facing distressed sales or an oversupply of homes, Austin’s sellers are generally under little pressure to make rapid price reductions, allowing them to wait for an optimal selling period.

Moreover, Austin’s ongoing population growth and desirable job market provide demand stability, even if many buyers remain hesitant to act in the current environment. This resilience mitigates the likelihood of a market crash, suggesting that Austin’s housing market will continue at a slower pace rather than facing a dramatic collapse.

People are Asking

- What is the interest rate for a mortgage in Austin Texas?

- What are mortgage rates in Texas right now?

- What is the interest rate for home buyers in Texas?

- Will mortgage rates go down in Texas?

- How much is PMI in Austin?

- How to buy down interest rate?

- What is a good interest rate on property?

- What will the mortgage rate be in 2024?

- Should I lock in my mortgage rate today?

- Are home prices declining in Texas?

Conclusion

Although the Federal Reserve’s recent rate cuts have sparked some optimism for Austin’s housing market, lower interest rates alone are unlikely to be a silver bullet. A gap between buyer expectations and seller prices, compounded by high Austin home prices and limited resale options, continues to slow transactions. Austin’s market is complex, where new builds in the suburbs offer an alternative path for buyers while urban resale options remain stagnant. Understanding these dynamics is key for prospective buyers, sellers, and investors alike as they navigate an uncertain but stable housing landscape in Austin.

Frequently Asked Questions

What is the impact of the recent Federal Reserve rate cut on the housing market?

The recent Federal Reserve rate cut is expected to have some influence on the housing market, but it may not be as impactful as some people hope, especially in Austin. Even if mortgage rates dip, they’re projected to remain higher than recent lows, which may not be enough to significantly boost home sales.

How has the housing market changed since the Fed last cut rates in 2020?

In 2020, when the Fed lowered rates amid the pandemic, home prices surged due to heightened demand and limited supply. However, since rates began to climb in 2022, home sales have dropped significantly, and transaction numbers continue to be lower than in previous years.

Are new construction homes more affordable than resale homes in Austin?

Yes, in many parts of the Austin Metro area, new builds have been more affordable than resales. For instance, new homes in Buda and Kyle are only slightly higher in price than resale homes. However, within Austin, new constructions tend to be priced significantly higher than resales.

Why are so many homes in Austin staying on the market for extended periods?

Many Austin homeowners are not pressured to sell, allowing them to wait for their desired price. High mortgage rates and buyer expectations of price drops have slowed transactions, resulting in a growing number of listings that remain active for over 120 days.

Will lower mortgage rates close the gap between buyer and seller expectations?

Lower mortgage rates may encourage some buying activity, but they may not fully bridge the gap between what sellers want and what buyers are willing to pay. While there is hope for increased transactions, the expectation of a major market collapse is unlikely.

Has the recent Federal Reserve rate cut improved the housing market?

The recent Federal Reserve rate cut may not have as significant an impact on the housing market as some hoped, especially in places like Austin. While lower rates can reduce borrowing costs, mortgage rates are still expected to land in the high 5% range by year-end. This rate remains higher than the promotional rates offered on new construction homes in recent years, which could limit its appeal to those considering resale homes.

How has the Austin housing market responded to the interest rate changes?

Austin’s housing market remains challenging due to high listing prices, particularly for resale homes. While transaction numbers have dropped sharply, homes are still selling, though at a slower pace. New construction homes have also become a popular option, especially in areas outside Austin where land is more abundant and prices are lower.

Are more buyers choosing new construction over resale homes?

Yes, new construction homes are in demand, particularly in Austin’s surrounding areas like Buda and Kyle. These homes often come with competitive pricing and promotional interest rates, attracting buyers who prefer new builds. However, in Austin itself, where new builds are limited, they tend to be priced significantly higher than resale homes.

Why are so many Austin homes staying on the market longer?

Many Austin homeowners remain firm on their asking prices, resulting in listings that stay on the market longer. Buyers are often hesitant to meet these prices, holding out for potential drops. Some 30% of Austin’s active listings have been on the market for over 120 days, indicating a persistent gap between seller expectations and buyer willingness.

Will mortgage rate cuts encourage people to buy homes?

While mortgage rates may dip slightly, it’s uncertain if this will spur significant buyer activity in the Austin market. Many potential buyers are waiting for a market correction, hoping for lower prices. However, without a compelling financial incentive, sellers may not be inclined to reduce their prices substantially.