If you’re still not convinced that real estate is the best choice for your long-term investing strategy, consider this example.

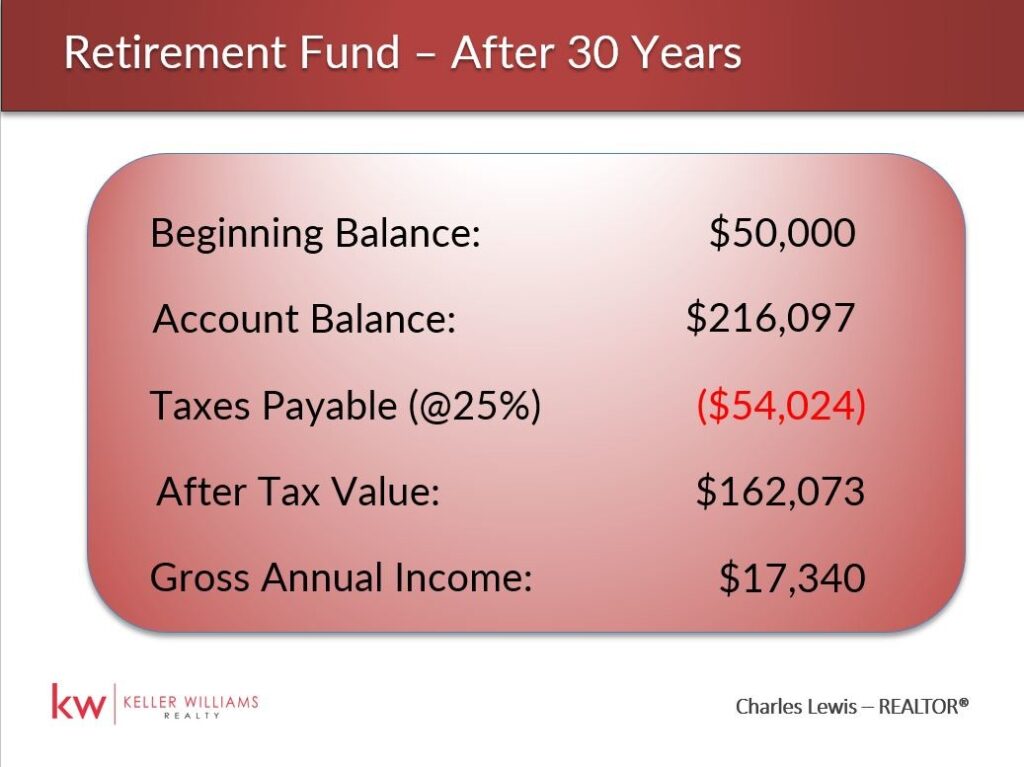

If you diversified your $50,000 retirement fund in stocks, bonds and mutual funds and were able to maintain a 5% annual growth, you would have a balance of $216,097 after 30 years.

If you paid your taxes (ordinary income,) put the balance in an annuity and took a yearly payment for 20 years, you would have $17,340 per year to supplement your Social Security.

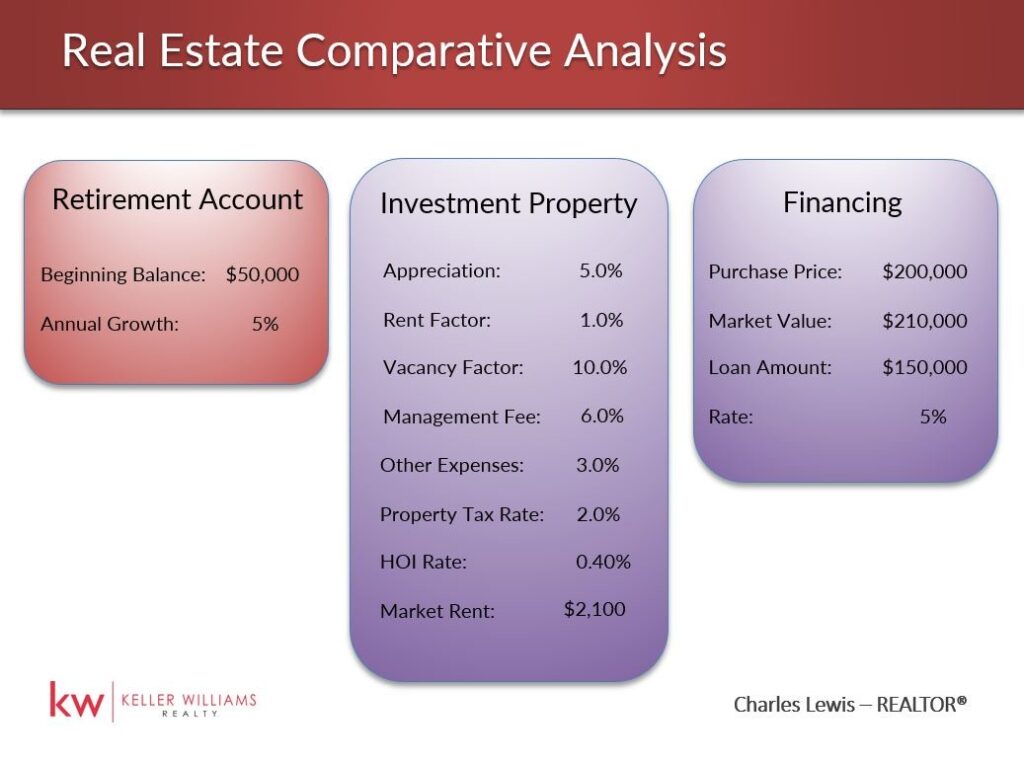

If you used that same $50,000 as a down payment on a $200,000 rental property and assumed a 5% appreciation rate along with the other factors here:

After 30 years, the property would be worth $907,608. You could sell it, and after you paid your taxes (capital gains) and put the balance in an annuity, you would have a yearly payment of $72,829 for 20 years. This is over 4 times more than the equities account!

Don’t forget that you’ve also received $1,674,259 in gross rental income over the 30 years.

Your other option would be keep the property as a rental which would provide $84,019 in net rental income in the 30th year.

Additional Information

Special thanks to Vestell Wright at Equity Prime Mortgage for doing all the math.