As a realtor and recent home buyer, I understand the intricacies of the home buying process. This article is designed to guide you through the key aspects of buying a house in Austin, drawing from my personal experiences and professional insights. Whether you’re a first-time buyer or looking to relocate within Austin, you’ll find valuable information to help you make an informed decision while discovering the perfect home.

Navigating the Austin Housing Market

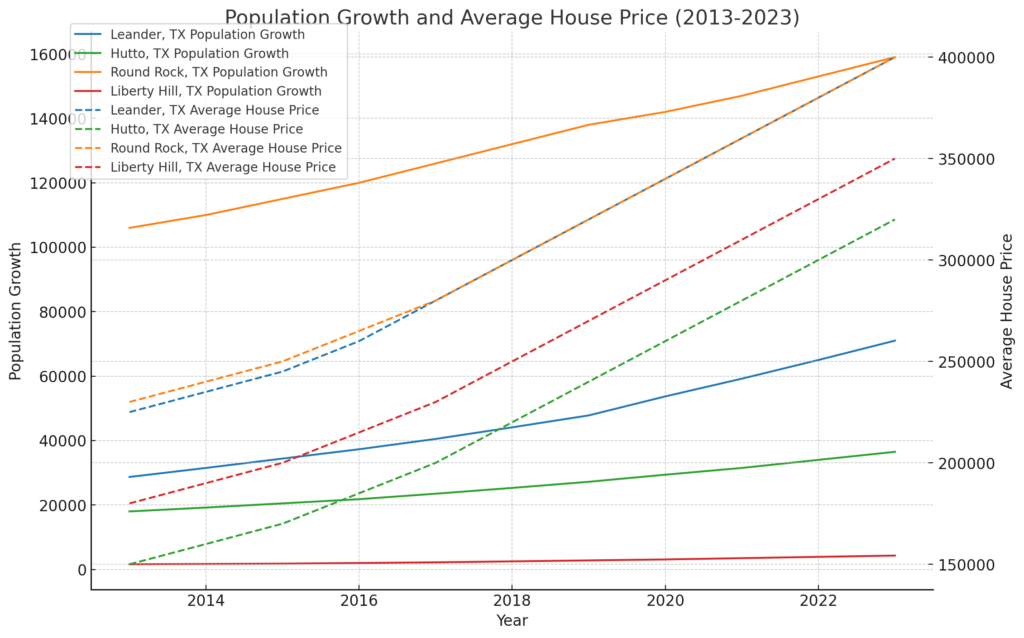

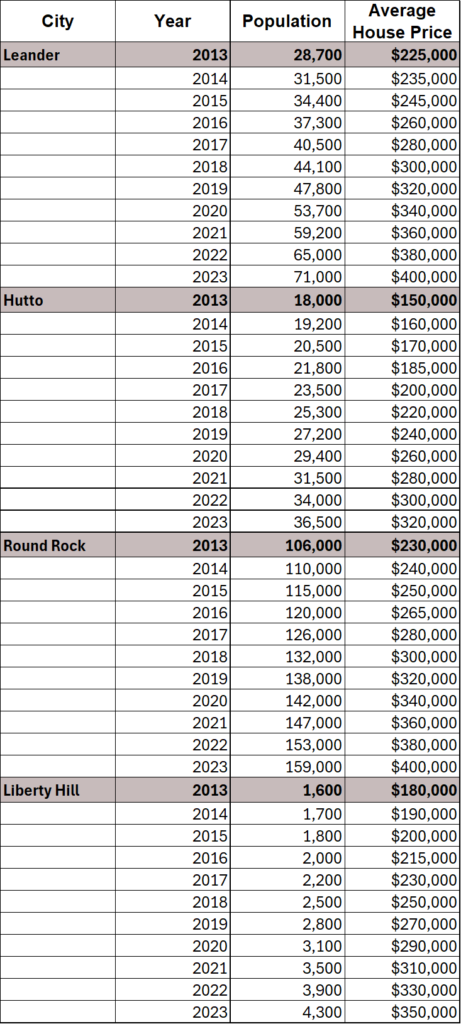

Buying a home in Austin has become increasingly competitive, especially during peak periods like 2021 and 2022. The Austin housing market experienced a significant surge in demand, with houses often selling above the asking price. This trend was driven by a combination of low interest rates and an influx of new residents. As a result, prospective buyers had to act quickly and decisively, often bidding over the list price to secure a property.

Understanding the market dynamics is crucial for anyone looking to buy a house in Austin. It’s essential to monitor trends, such as appreciation rates and inventory levels, to make informed decisions. During the peak periods, appreciation rates soared, sometimes reaching 30% annually. While such growth is unsustainable long-term, it highlighted the high demand for Austin real estate. This knowledge can help buyers anticipate market shifts and adjust their strategies accordingly.

Timing Your Purchase in Austin

The timing of your home purchase can significantly impact the overall cost and experience. In late 2023, interest rates began to decline, creating an opportune moment for home buyers. Lower interest rates reduce monthly mortgage payments, making homes more affordable. This trend provided a window of opportunity for buyers who had been priced out of the market during the peak frenzy.

For those considering buying a house in Austin, it’s vital to stay updated on economic indicators and Federal Reserve policies. These factors influence interest rates and, consequently, housing affordability. By understanding the broader economic context, buyers can better predict favorable times to enter the market. Additionally, seasonal trends can affect housing availability and pricing, with spring and summer typically seeing higher activity levels.

Discovering the Perfect Home in the Right Area in Austin

Austin’s diverse neighborhoods offer various living experiences, each with unique advantages and drawbacks. Northern suburbs like Leander, Cedar Park, and Liberty Hill have become popular due to their relative affordability and rapid growth. These areas provide ample new construction options, modern amenities, and a more suburban lifestyle while still being accessible to downtown Austin.

On the other hand, South Austin offers a vibrant urban experience with closer proximity to the city center and its amenities. However, it faces challenges such as limited major interstates, which can affect commute times. Prospective buyers must weigh these factors, considering their lifestyle preferences and daily needs. Proximity to work, schools, and recreational activities can significantly influence the desirability of different areas.

Budgeting for Your Austin Home

Setting a realistic budget is a critical step in the home buying process. In Austin, homes within the $400,000 to $500,000 range offer varied options depending on location. Within the city limits, this budget might secure an older home, which could require renovations. However, in the northern suburbs, the same budget can often afford a new construction with modern amenities.

Prospective buyers should consider the total cost of ownership, including property taxes, maintenance, and potential renovation costs. It’s also beneficial to get pre-approved for a mortgage to understand your borrowing capacity and streamline the buying process. Comparing different financing options and understanding your financial limits will help you avoid overextending yourself and ensure a sustainable investment.

Future Development Plans in Northern Austin Suburbs

- New Roadway Expansions

- Extension of the 183A Toll Road to enhance connectivity, reducing travel time between Leander and Cedar Park.

- Widening of I-35 to reduce congestion and improve commute times, especially during peak hours.

Public Transportation Projects

- Introduction of new bus routes by Capital Metro, including routes connecting Leander and Liberty Hill to downtown Austin.

- Plans for Project Connect’s light rail system to link northern suburbs like Pflugerville and Georgetown to central Austin.

Commercial and Retail Development

- Construction of the Northline mixed-use development in Leander, which includes retail shops, restaurants, and office spaces.

- Expansion of The Domain in North Austin, adding more retail and dining options close to northern suburbs.

Residential Developments

- Development of the Bryson community in Leander, offering a mix of single-family homes and amenities like parks and trails.

- Introduction of affordable housing projects in Cedar Park, such as the planned Cedar Park Town Center.

Educational Facilities

- Construction of the new Danielson Middle School in Leander ISD to accommodate the growing student population.

- Expansion of Austin Community College’s San Gabriel Campus in Leander to offer more programs and facilities.

Healthcare Infrastructure

- Building the new Cedar Park Regional Medical Center to improve access to medical services for northern suburb residents.

- Expansion of St. David’s Healthcare facilities in Round Rock to provide comprehensive care.

Evaluating New Construction vs. Older Homes

When deciding between new construction and older homes, buyers must consider factors such as maintenance, energy efficiency, and design preferences. New constructions in the Austin suburbs often come with modern layouts, energy-efficient features, and builder warranties, reducing the immediate need for repairs. These homes are particularly appealing to buyers looking for a turnkey solution.

Conversely, older homes in established neighborhoods may offer unique architectural features and proximity to urban amenities. However, they might require significant renovations and updates. Buyers should conduct thorough inspections and consider potential renovation costs when evaluating older properties. Balancing these factors will help you find a home that meets your needs and budget.

The Impact of School Districts on Home Values

School districts play a crucial role in determining home values and the long-term desirability of a neighborhood. In Austin, areas with highly-rated school districts, such as Leander and Round Rock, tend to attract more buyers and command higher prices. Even if you don’t have school-aged children, the quality of local schools can influence future resale value and the attractiveness of your property to potential tenants.

Prospective buyers should research school ratings and district boundaries when evaluating different areas. Websites like GreatSchools.org provide detailed information on school performance, helping buyers make informed decisions. Investing in a home within a reputable school district can offer long-term benefits, enhancing both property value and community stability.

Understanding Market Corrections and Trends

The Austin housing market has seen both rapid appreciation and subsequent corrections. Understanding these trends can help buyers navigate the market more effectively. While the peaks of 2021 and 2022 led to unprecedented price increases, the market has since adjusted, providing more balanced conditions. These corrections are part of a healthy market cycle, helping to stabilize prices and ensure sustainable growth.

Prospective buyers should stay informed about market trends and economic indicators. Resources like the Austin Board of Realtors and national housing reports offer valuable insights into market conditions. By keeping abreast of these trends, buyers can better anticipate changes and make strategic decisions about when to enter the market.

The Role of Interest Rates in Home Buying

Interest rates are a key factor in determining the affordability of a home. During periods of low interest rates, buyers can secure lower monthly mortgage payments, making homeownership more accessible. Conversely, rising interest rates can increase borrowing costs, potentially pricing some buyers out of the market.

Staying informed about Federal Reserve policies and economic forecasts can help buyers anticipate changes in interest rates. Working with a knowledgeable mortgage broker can also provide valuable guidance on locking in favorable rates. Understanding how interest rates impact your buying power is essential for making informed decisions and optimizing your home purchase.

Incentives and Discounts from Builders

Builders often offer various incentives to attract buyers, particularly during slower market periods or at the end of the fiscal year. These incentives can include price reductions, closing cost assistance, and upgrades such as appliances or enhanced finishes. For buyers, these incentives can significantly enhance the value of a new construction home.

Prospective buyers should explore different builders and compare the incentives they offer. Visiting model homes and attending open houses can provide a firsthand look at the available options. By taking advantage of these incentives, buyers can potentially secure a better deal and customize their new home to their preferences.

Pros and Cons of Suburban Living

Suburban living offers a distinct lifestyle compared to urban areas. In Austin, suburbs like Leander and Cedar Park provide a quieter environment, larger lots, and modern amenities. These areas are ideal for families seeking more space and a community-oriented atmosphere. Additionally, suburban homes often come with newer construction and lower property taxes compared to city properties.

However, suburban living may require longer commutes and less immediate access to cultural and recreational activities found in the city center. Buyers should consider their daily routines, work locations, and lifestyle preferences when evaluating suburban options. Balancing these factors will help you determine if suburban living aligns with your needs and expectations.

The Growth of Northern Austin Suburbs

The northern suburbs of Austin, including Leander, Cedar Park, and Liberty Hill, have experienced significant growth in recent years. This expansion is driven by affordable housing, new developments, and improved infrastructure. These areas offer a blend of suburban tranquility and proximity to Austin’s bustling urban core, making them attractive to a diverse range of buyers.

Investing in the northern suburbs can offer long-term benefits due to ongoing development and population growth. Buyers should research planned projects and future developments that could impact property values. Understanding the growth trajectory of these areas can help buyers make informed decisions and capitalize on potential appreciation.

Future Resale and Rental Potential

When buying a home, it’s important to consider future resale and rental potential. In Austin, areas with strong job markets, reputable schools, and ongoing development tend to maintain higher demand and property values. Northern suburbs like Leander and Cedar Park, with their expanding infrastructure and amenities, offer promising prospects for future resale and rental opportunities.

Buyers should assess the long-term viability of their investment by researching market trends and economic forecasts. Understanding the factors that drive demand in specific neighborhoods will help you make a more informed decision. Whether you plan to resell or rent out your property in the future, considering these aspects will ensure a wise investment.

Conclusion

Buying a home in the Austin area involves careful consideration of various factors, from market trends and interest rates to location and budget. My experience in purchasing a home in Leander provides valuable insights into navigating this dynamic market. By understanding the key elements of the home buying process and staying informed about market conditions, you can make a confident and informed decision. Whether you’re a first-time buyer or looking to relocate within Austin, these insights will help you find the perfect home.

Frequently Asked Questions

Q. What are the main factors to consider when buying a home in Austin?

Q. How do school districts impact home values in Austin?

Q. Are there incentives available for buying new construction homes in Austin?

Q. What is the downside of living in Austin Texas?

Q. What credit score is needed to buy a $300K house?

Additional Questions People are Asking:

- What salary do you need to buy a house in Austin?

- Is it worth buying a house in Austin?

- How much do you need for a down payment on a house in Austin?

- How to buy a home for the first time in Texas?

- Can I afford a house on 70k a year?

- What is a livable salary in Austin Texas?

- What is the downside of living in Austin Texas?

- Are Austin TX home prices dropping?

- Is Austin becoming unaffordable?

- How much down payment for a 500k house?

- What is the minimum down payment on a $250000 house?

- How much down payment for a 200k house?

- How much money should I save before buying a house in Texas?

- What is the income limit for first-time home buyers in Texas?

- What benefits do first-time home buyers get in Texas?