Over the past year, mortgage rates have fallen more than a full percentage point. This is a great driver for homeownership, as today’s low rates provide consumers with some significant benefits. Here’s a look at three of them:Refinance: If you already own a home, you may want to decide if you’re going to refinance. It’s one way to lock in a … Read More

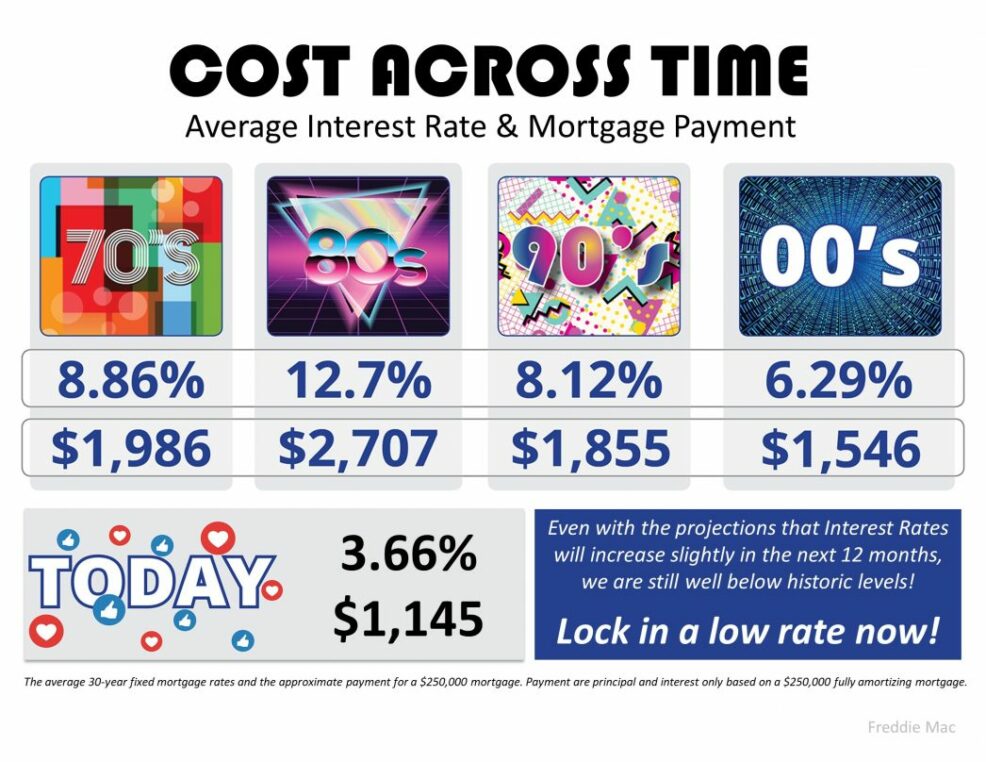

The Cost Across Time [INFOGRAPHIC]

Some Highlights: With interest rates around 3.66%, now is a great time to look back at where they’ve been over the past few decades. Comparatively, they’re pretty low! According to Freddie Mac, rates are projected to increase to 3.9% by this time next year. The impact your interest rate has on your monthly mortgage payment is significant. An increase of just $20 … Read More

2 Myths Holding Back Home Buyers

In a recent article, First American shared how millennials are not really any different from previous generations when it comes to the goal of homeownership; it is still a huge part of their American Dream. The piece, however, also reveals, “Saving for a down payment is one of the biggest obstacles faced by first-time home buyers. Dispelling the 20 percent down payment … Read More

This is Not 2008 All Over Again: The Mortgage Lending Factor

Some are afraid the real estate market may be looking a lot like it did prior to the housing crash in 2008. One of the factors they’re pointing at is the availability of mortgage money. Recent articles about the availability of low-down payment loans and down payment assistance programs are causing concern that we’re returning to the bad habits of … Read More

75 Years of VA Home Loan Benefits

Today, on Veterans Day, we salute those who have served our country in war or peace, and we thank them for their sacrifice. This year marks the 75th anniversary of VA Home Loan Benefit offerings through the Servicemen’s Readjustment Act, also known as the GI Bill. Since 1944, this law has created opportunities for those who have served our country, ranging from vocational … Read More

Forget the Price of the Home. The Cost is What Matters.

Home buying activity (demand) is up, and the number of available listings (supply) is down. When demand outpaces supply, prices appreciate. That’s why firms are beginning to increase their projections for home price appreciation going forward. As an example, CoreLogic increased their 12-month projection for home values from 4.5% to 5.6% over the last few months. The reacceleration of home values will … Read More

What FICO® Score Do You Need to Qualify for a Mortgage?

While a recent announcement from CNBC shares that the average national FICO® score has reached an all-time high of 706, the good news for potential buyers is that you don’t need a score that high to qualify for a mortgage. Let’s unpack the credit score myth so you can to become a homeowner sooner than you may think. With today’s low interest rates, many … Read More

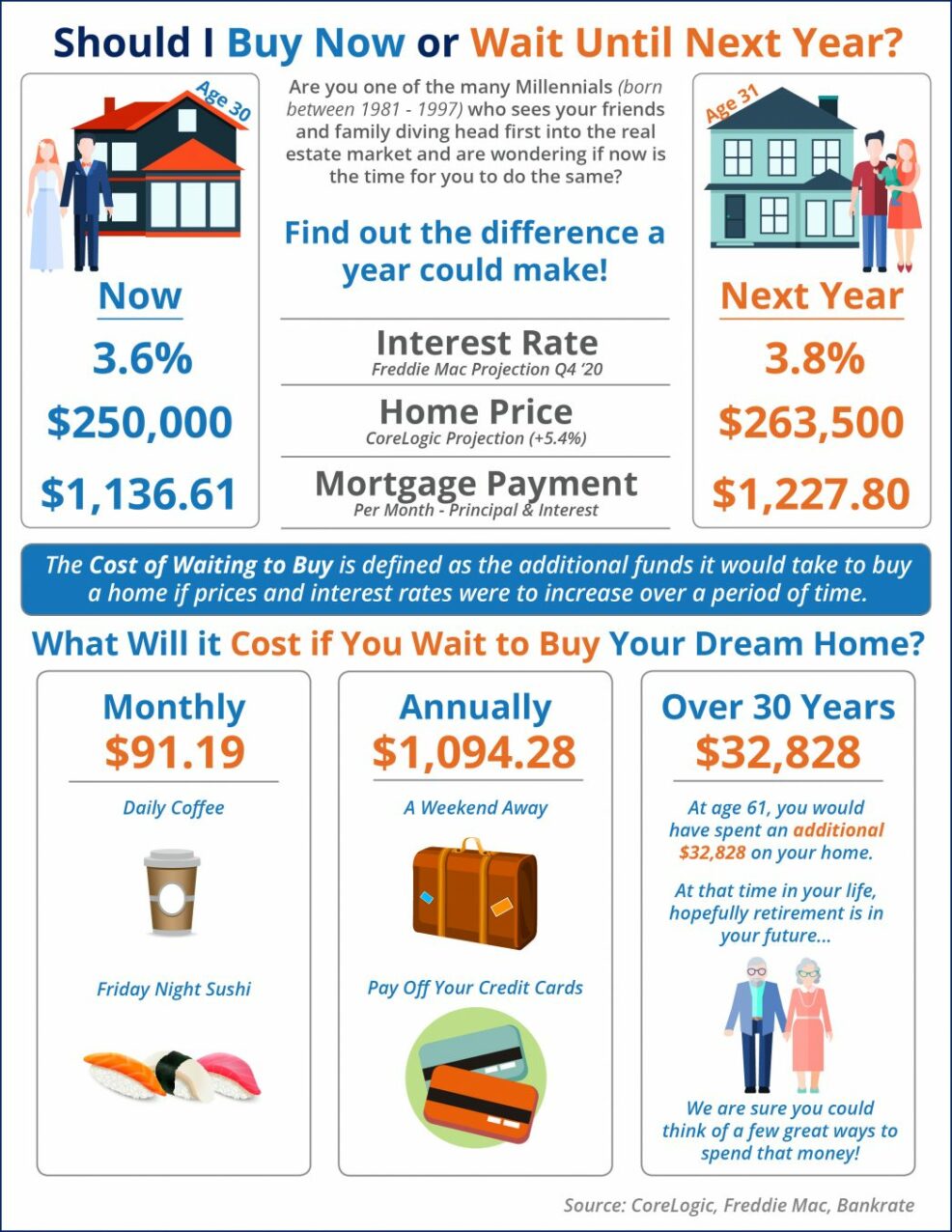

What Is the Cost of Waiting Until Next Year to Buy? [INFOGRAPHIC]

Some Highlights: The “cost of waiting to buy” is defined as the additional funds necessary to buy a home if prices and interest rates were to increase over a period of time. Freddie Mac forecasts interest rates will rise to 3.8% by Q4 2020. CoreLogic predicts home prices will appreciate by 5.4% over the next 12 months. If you’re ready and willing to buy … Read More