Over the past several weeks, Freddie Mac has reported the average 30-year fixed mortgage rate dropping to record lows, all the way down to 3.03%. Last week’s reported rate reached the lowest point in the history of the survey, which dates back to 1971 (See graph below): What does this mean for buyers? This is huge for homebuyers. Those currently taking advantage of the … Read More

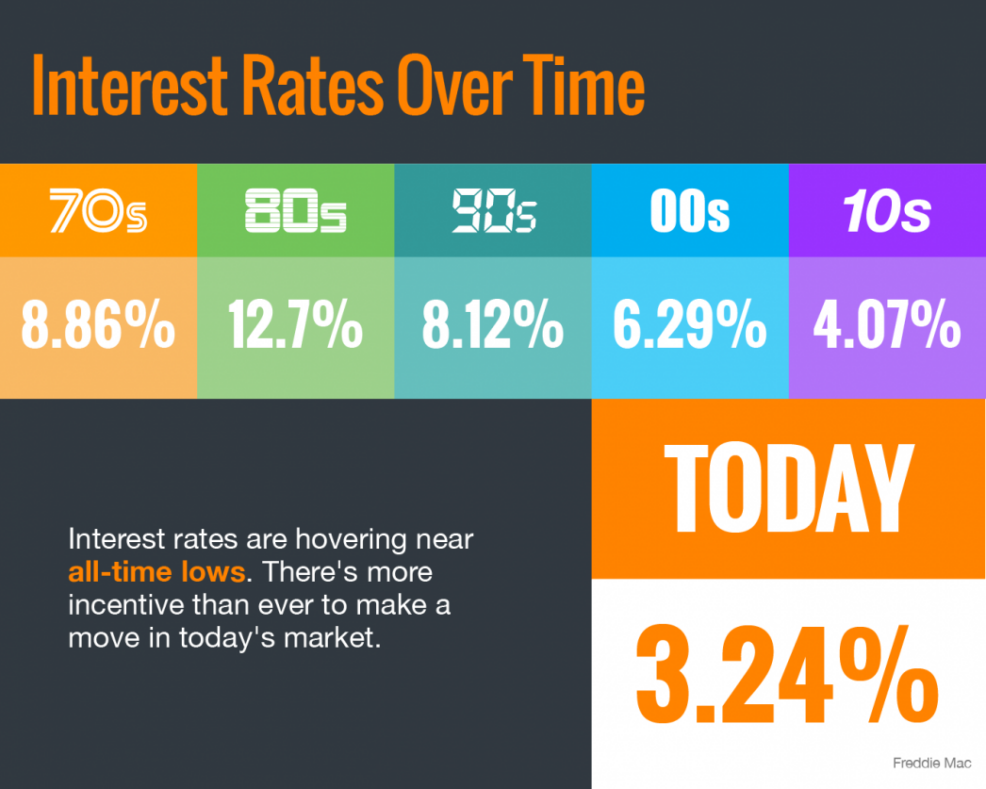

Interest Rates Hover Near Historic All-Time Lows [INFOGRAPHIC]

Some Highlights Mortgage interest rates have dropped considerably this spring and are hovering at a historically low level. Locking in at a low rate today could save you thousands of dollars over the lifetime of your home loan. Let’s connect to determine the best way to position yourself for a move in today’s market.

Is Now a Good Time to Refinance My Home?

With interest rates hitting all-time lows over the past few weeks, many homeowners are opting to refinance. To decide if refinancing your home is the best option for you and your family, start by asking yourself these questions: Why do you want to refinance? There are many reasons to refinance, but here are three of the most common ones: 1. Lower Your … Read More

How Interest Rates Can Impact Your Monthly Housing Payments

Spring is right around the corner, so flowers are starting to bloom, and many potential homebuyers are getting ready to step into the market. If you’re thinking of buying this season, here’s how mortgage interest rates are working in your favor. Freddie Mac explains: “If you’re in the market to buy a home, today’s average mortgage rates are something to celebrate … Read More

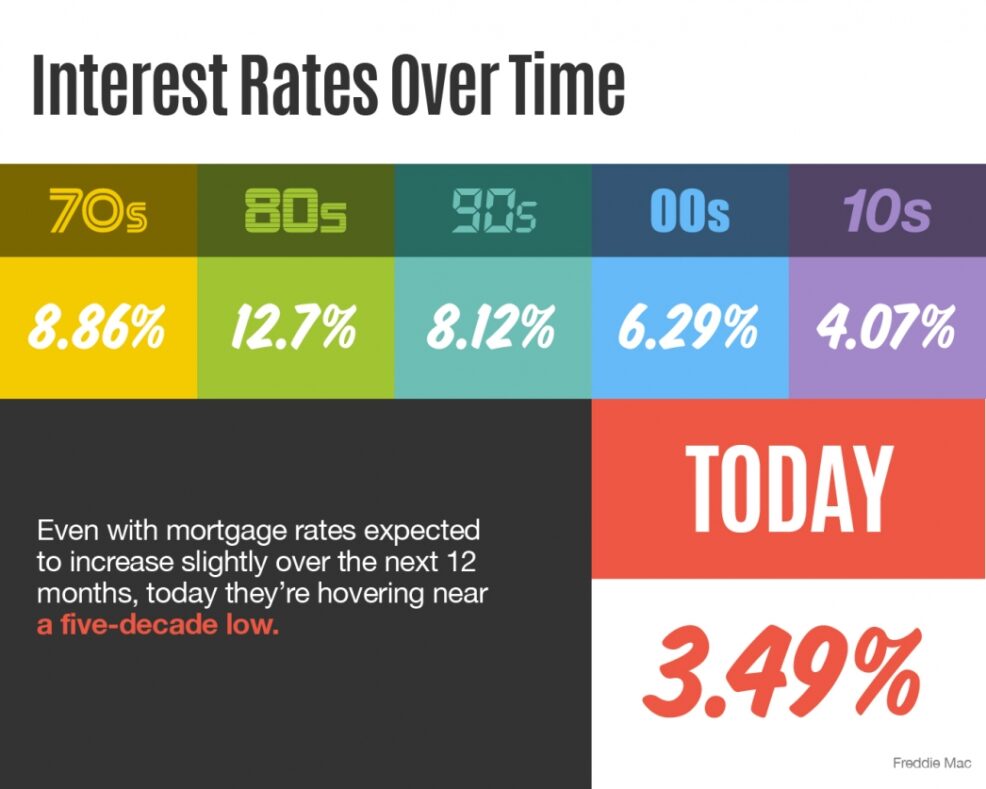

Interest Rates Over Time [INFOGRAPHIC]

Some Highlights: With interest rates hovering at near historic lows, now is a great time to look back at where they’ve been, and how much they’ve changed over time. According to Freddie Mac, mortgage interest rates are currently hovering near a five-decade low. The impact your interest rate has on your monthly mortgage payment is significant. An increase of just $20 dollars … Read More

What You Need to Know About the Mortgage Process [INFOGRAPHIC]

Some Highlights: Many buyers are purchasing homes with down payments as little as 3%. You may already qualify for a loan, even if you don’t have perfect credit. Your local professionals are here to help you determine how much you can afford, so take advantage of the opportunity to learn more.

Three Reasons Why Pre-Approval Is the First Step in the 2020 Home Buying Journey

When the number of buyers in the housing market outnumbers the number of homes for sale, it’s called a “seller’s market.” The advantage tips toward the seller as low inventory heats up the competition among those searching for a place to call their own. This can create multiple offer scenarios and bidding wars, making it tough for buyers to land their dream homes … Read More

How Buyers Can Win By Downsizing in 2020

Home values have been increasing for 93 consecutive months, according to the National Association of Realtors. If you’re a homeowner, particularly one looking to downsize your living space, that’s great news, as you’ve likely built significant equity in your home. Here’s some more good news: mortgage rates are expected to remain low throughout 2020 at an average of 3.8% for a 30-year fixed-rate loan. The combination … Read More

The 2 Surprising Things Homebuyers Really Want

In a market where current inventory is low, it’s normal to think buyers might be willing to give up a few desirable features in their home search in order to make finding a house a little easier. Don’t be fooled, though – there’s still an interest in the market for some key upgrades. Here’s a look at the two surprising things buyers … Read More