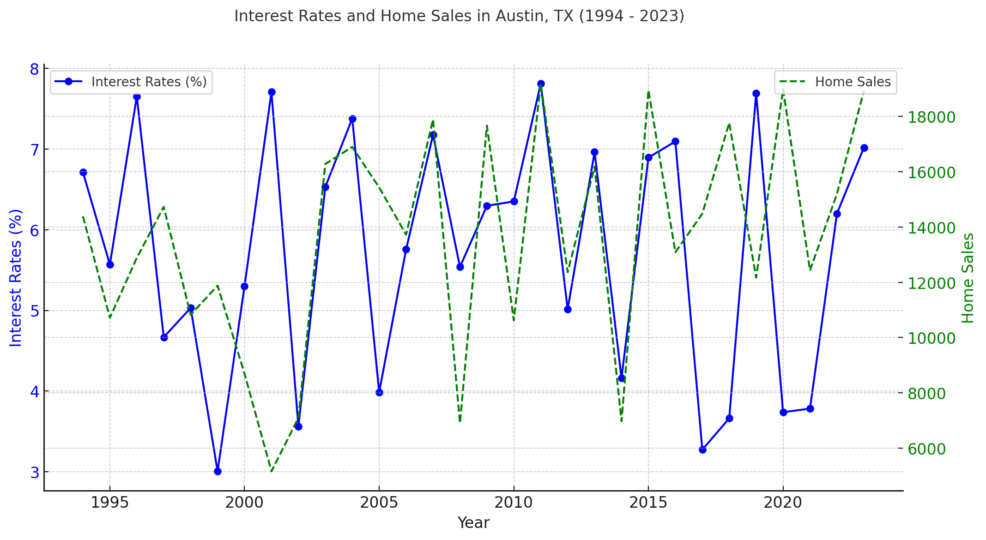

Austin high home prices and limited resale options mean that simply reducing interest rates may not be enough to bridge the gap between buyer and seller expectations.

More BAD NEWS for Austin Housing Market

A sudden surge in housing inventory, unseen in over a decade, has created a surplus that has dampened median prices and intensified competition among sellers. Economic uncertainties and fluctuating interest rates have added to the complexity, posing risks for both buyers and sellers. The market dynamics have shifted, making it difficult for sellers to close deals and requiring more strategic pricing and marketing approaches … Read More

Real Estate Secrets Dave Ramsey NEVER Tells You About

When it comes to financial advice, Dave Ramsey is a household name, especially for those looking to get out of debt and build a solid financial foundation. His guidance has helped millions avoid financial pitfalls, but there are certain aspects of real estate that his teachings often overlook. Understanding these gaps can be crucial for those looking to achieve their real estate goals … Read More

Unaffordable Housing is a GOOD THING

For decades, experts and commentators have repeatedly warned about the unsustainable rise in home prices and the growing divide between those who can afford to buy and those who cannot. However, there’s a compelling argument to be made that unaffordable housing is not necessarily a bad thing. In fact, it can be a reflection of economic prosperity and long-term investment potential … Read More

Why you’ll NEVER BUY A HOUSE (and ALWAYS be a RENTER)

Buying a house is a dream for many, but for some, it remains just that—a dream. There are several critical mistakes and misconceptions that can keep you renting forever. Understanding these pitfalls is essential if you want to break free from the cycle of renting and finally own a home … Read More

47% of New Buyers Surprised by How Affordable Homes Are Today

Headlines matter. Right now, it’s hard to read about real estate without seeing a headline that suggests homes have become unaffordable for most Americans. In reality, there’s hard evidence that shows how owning a home is more affordable than renting in most parts of the country, as record-low interest rates are keeping monthly mortgage payments about 23% lower than the typical payment of 20 … Read More

Do You Need to Know More about Forbearance and Mortgage Relief Options?

Earlier this year when the nation pressed pause on the economy and unemployment rates jumped up significantly, many homeowners were immediately concerned about being able to pay their mortgages, and understandably so. To assist in this challenging time, two protection plans were put into place to help support those in need. First, there was a pause placed on initiating foreclosures for government-backed … Read More

The Cost of a Home Is Far More Important than the Price

Housing inventory is at an all-time low. There are 39% fewer homes for sale today than at this time last year, and buyer demand continues to set records. Zillow recently reported: “Newly pending sales are up 25.5% compared to the same week last year, the highest year-over-year increase in the weekly Zillow database.” Whenever there is a shortage in supply of an item that’s in … Read More

Homes Are More Affordable Right Now Than They Have Been in Years

Today, home prices are appreciating. When we hear prices are going up, it’s normal to think a home will cost more as the trend continues. The way the housing market is positioned today, however, low mortgage rates are actually making homes more affordable, even as prices rise. Here’s why. According to the Mortgage Monitor Report from Black Knight: “While home prices have risen for 97 … Read More