Key Takeaways

- Account for costs beyond the selling price, such as closing fees, property taxes, and HOA fees, to avoid surprises.

- Use a knowledgeable realtor to negotiate closing costs and understand what’s included in the home price.

- Factor in expenses like lawn care, utilities, and maintenance to manage your home’s upkeep.

- In hard water areas, invest in a water softener and filtration system to protect pipes and appliances.

- Choose the right water treatment system by consulting specialists and understanding your water quality needs.

Buying a new construction home involves more than just the selling price of the house. There are numerous additional expenses that buyers need to be aware of to avoid unexpected surprises. Properly identifying and budgeting for these costs is crucial for a smooth and financially stable home-buying experience. This guide will cover the various costs associated with purchasing a new construction home, including a commonly overlooked expense that can significantly impact your home’s long-term value.

Identifying Additional Expenses

When budgeting for a new home, it’s essential to account for expenses beyond the selling price. Closing costs, property taxes, HOA fees, and other miscellaneous charges can add up quickly. By identifying these costs early, you can better prepare and avoid financial surprises. A good realtor can often negotiate with the builder to cover some of these fees, helping to alleviate some of the financial burdens at closing.

Post-closing expenses are another area where new homeowners need to be vigilant. Lawn care, whether you hire someone or do it yourself, is a mandatory cost that should be factored into your budget. Failure to maintain your lawn can result in fines from the HOA. Additionally, utilities and other ongoing expenses need to be accounted for to ensure you can comfortably manage your new home’s upkeep.

Closing Costs Breakdown

Closing costs encompass various fees and charges that come with finalizing the purchase of your home. These can include the title policy, property taxes, and HOA transfer fees, among others. The title company typically handles these fees, and a detailed breakdown is provided during the closing process. It’s essential to review these costs thoroughly and understand each item to avoid any confusion or unexpected expenses.

A savvy realtor can be a valuable asset during this phase, potentially negotiating with the builder to cover some or all of these fees. Builders may be willing to pay certain closing costs to secure the sale, which can significantly reduce your out-of-pocket expenses. Always consult with your realtor and leverage their expertise to navigate the closing cost negotiations effectively.

Negotiating with Builders

Negotiating with builders can save you a considerable amount of money on closing costs and other fees. Builders often have some flexibility in their pricing and may be willing to cover certain expenses to close the deal. A knowledgeable realtor can help you identify which costs can be negotiated and work to get the best possible terms for your purchase.

Additionally, it’s essential to understand what is and isn’t included in the base price of your new construction home. Builders may exclude certain items to keep the initial price attractive. Reviewing the sales contract thoroughly and asking detailed questions about inclusions can prevent surprises down the line. Knowing what you’re getting—and what you’re not—will help you budget more accurately for any additional expenses.

Post-Closing Financial Preparation

After closing on your new home, there are numerous expenses to consider. Lawn care is one such expense that is often overlooked but essential for maintaining your property’s appearance and complying with HOA regulations. Whether you choose to hire a service or purchase equipment to do it yourself, budgeting for this cost is crucial to avoid fines and maintain your home’s curb appeal.

Other post-closing expenses include utilities, home maintenance, and potential repairs. These ongoing costs can add up quickly, so it’s vital to have a financial plan in place. Setting aside a portion of your budget for unexpected repairs and routine maintenance can help ensure that you are financially prepared for any issues that may arise.

Consumer Financial Protection Bureau (CFPB):

The CFPB offers detailed guidance on steps to take post-closing, including updating utility accounts, scheduling home inspections, and securing homeowner’s insurance. They emphasize the importance of responding promptly to lender requests and setting up utilities to ensure a smooth transition into your new home,

HUD (U.S. Department of Housing and Urban Development):

HUD’s closing guide highlights necessary steps such as obtaining title insurance, scheduling final inspections, and ensuring all closing documents are in order. They also provide checklists for ensuring all requirements are met and recommendations for handling various post-closing tasks.

Common Assumptions

Many new homeowners assume that certain appliances and features are included with their new construction home. Items like refrigerators, washers, and dryers are often not included, especially in lower-priced homes. Builders exclude these items to keep the base price attractive, meaning buyers need to budget for these essential appliances separately.

Understanding what is and isn’t included in your home purchase is crucial to avoid surprises. Reviewing the sales contract thoroughly and asking the builder for a list of included items can help you identify any gaps. This knowledge allows you to budget for any additional purchases you’ll need to make after moving in.

Appliances: Attached vs. Unattached

In new construction homes, certain appliances like stoves, microwaves, and dishwashers are typically included because they are attached to the house. However, unattached appliances such as refrigerators and laundry machines often are not. This means you may need to purchase these items separately after moving in, which can be a significant expense.

Before closing on your home, make sure to get a comprehensive list of what’s included and what’s not. This will help you plan your budget accordingly and avoid unexpected costs. If appliances are not included, consider shopping around for the best deals and factoring these expenses into your overall home-buying budget.

Importance of a Water Softener

The number one unexpected expense when buying new construction isn’t related to mandatory costs like lawn care or utilities. Instead, it’s something that, if ignored, can devalue your home and lead to higher maintenance costs over time. This expense often catches new homeowners by surprise because it’s not typically included in the initial home purchase agreement.

Builders might hint at this expense by pre-plumbing for a water softener in the garage. This setup indicates that the water in your area may be hard, leading to potential damage to your pipes and appliances over time. Installing a water softener can prevent these issues and save you money in the long run by reducing maintenance and repair costs.

Hard water can cause significant wear and tear on your pipes and appliances, leading to higher maintenance costs over time. Installing a water softener helps to mitigate these issues by reducing the mineral content in your water.

Geographic Factors

The geography of your area plays a crucial role in determining water quality. In regions like the Hill Country, where the soil is rocky, water tends to have higher sediment levels. This sediment can lead to increased wear and tear on your home’s plumbing and appliances, necessitating the need for a water softener.

Understanding the local geography and its impact on water quality can help you make informed decisions about necessary home improvements. Investing in a water softener can prevent future issues and save you money on repairs and maintenance, making it an essential consideration for new homeowners in areas with hard water.

Water Quality Concerns

In addition to sediment, chemicals in your water can also pose a concern. Water treatment plants process water before it reaches your home, but they can’t remove all contaminants. Testing your water can reveal the presence of chemicals that may require additional filtration to ensure safe drinking and usage.

A water softener alone may not be sufficient to address all water quality issues. To ensure your water is safe and clean, consider installing a comprehensive water filtration system. This investment can improve the overall quality of your water, protect your plumbing, and enhance the longevity of your appliances.

Choosing a Water Filtration System

Choosing the right water filtration system involves understanding your specific water quality needs. Simple water softeners can address mineral content, but more complex issues may require an all-in-one system that also filters out chemicals. These systems can range in price and effectiveness, so it’s essential to research your options thoroughly.

All-in-one units, which combine water softening and filtration, can be a more cost-effective solution for addressing multiple water quality issues. While these systems can be more expensive upfront, their long-term benefits often justify the investment. Consider consulting with a water treatment specialist to find the best solution for your home.

Personal Experience with Water Systems

When I moved into my new home, I quickly realized the importance of investing in a high-quality water system. I opted for a combination of a water softener, a whole-house filtration system, and a reverse osmosis unit under the kitchen sink. This setup provided me with clean, safe water for drinking and cooking, significantly improving my overall water quality.

My personal experience underscores the importance of not overlooking water treatment systems when buying a new home. While these systems can be costly, their benefits in terms of water quality and home maintenance make them a worthwhile investment. Researching and choosing the right system can save you money and improve your quality of life in the long run.

Builders might hint at this expense by pre-plumbing for a water softener in the garage. This setup indicates that the water in your area may be hard, leading to potential damage to your pipes and appliances over time. Installing a water softener can prevent these issues and save you money in the long run by reducing maintenance and repair costs.

21 Unexpected or Hidden Costs of Buying a Home

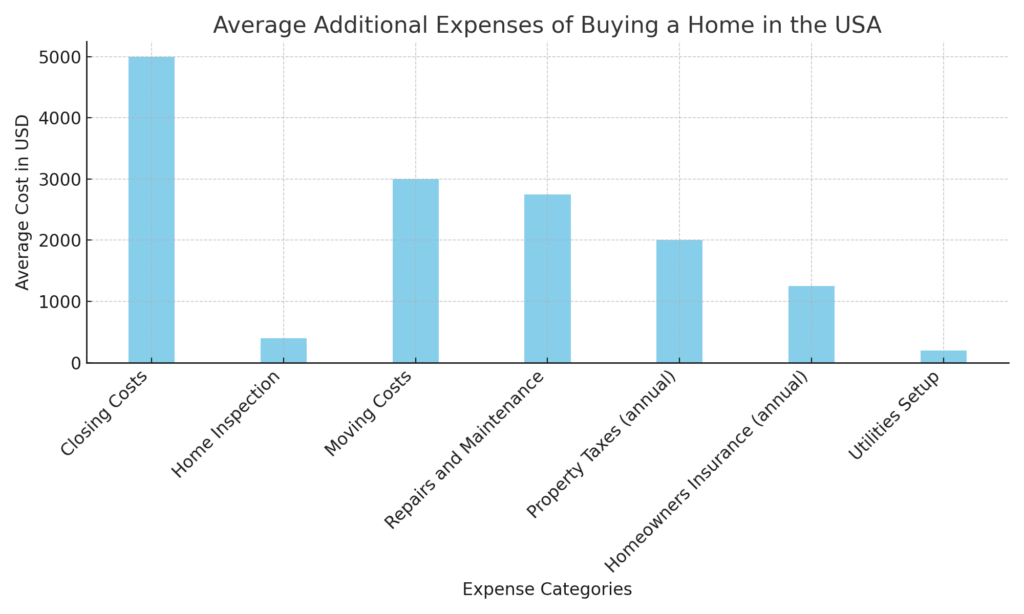

Beyond the initial purchase price, buying a home involves hidden costs such as inspection fees, appraisal fees, and closing costs including attorney fees and title insurance. Additionally, new homeowners should anticipate moving expenses, potential repairs, and ongoing costs like property taxes, homeowners insurance, and utilities. Understanding and budgeting for these expenses can help buyers avoid financial strain and ensure a smoother transition to homeownership.

What Are the Hidden Costs of Homeownership?

Homeownership entails several hidden costs beyond the mortgage payment. These include property taxes, homeowners insurance, and possibly private mortgage insurance if your down payment is less than 20%. Maintenance and repairs, such as roof replacements and HVAC system upkeep, can also add up. Landscaping, pest control, and potential HOA fees are additional expenses to consider. Being aware of these costs helps in better financial planning and prevents surprises.

The Hidden Costs of Owning a Home

Owning a home comes with various hidden costs that can strain your budget. These include regular expenses like property taxes, homeowners insurance, and utilities. Maintenance costs, such as roof repairs, HVAC servicing, and plumbing issues, are significant and often unpredictable. Additionally, homeowners should budget for renovations, pest control, and lawn care. Proper financial planning and setting aside funds for these expenses can help manage the true cost of homeownership effectively.

Time for Research

If you’re waiting for your house to be built, now is the perfect time to research water treatment options. Understanding your water quality needs and exploring various systems can help you make an informed decision before moving in. Take advantage of this time to consult with specialists and read reviews to find the best solution for your home.

Proper research and planning can help you avoid unexpected expenses and ensure your new home is equipped with a reliable water treatment system. By investing time in understanding your options, you can make a choice that will benefit your home’s value and your family’s health for years to come.

Builders might hint at this expense by pre-plumbing for a water softener in the garage. This setup indicates that the water in your area may be hard, leading to potential damage to your pipes and appliances over time. Installing a water softener can prevent these issues and save you money in the long run by reducing maintenance and repair costs.

Conclusion and Recommendations

Buying a new construction home comes with numerous expenses beyond the initial purchase price. From closing costs to essential home improvements like water treatment systems, it’s crucial to identify and budget for these costs to avoid financial surprises. Proper planning and research can help you make informed decisions and ensure a smooth transition into your new home.

In conclusion, don’t overlook the importance of a water softener and filtration system, especially if you’re moving to an area with hard water. Investing in these systems can protect your home and improve your quality of life. If you have any questions or need recommendations, don’t hesitate to reach out to a water treatment specialist. With the right preparation, you can enjoy your new home with peace of mind.