Key Takeaways

- High home prices, interest rates, and inflation might make the market seem terrible, but much of that is hype.

- Interest rates are unlikely to decrease soon, with cuts not expected until the end of 2024.

- Current housing inventory is high, offering more choices for buyers and pressuring sellers to price realistically.

- Many listings are priced under $300,000, and reduced investor activity makes it a favorable time for first-time buyers.

- Buyers need to assess true market value amid price corrections and act proactively to find hidden opportunities.

Current Housing Market Perception

High home prices, high interest rates, and high inflation might paint a grim picture of today’s housing market. However, much of this negative perception could be overhyped. While these factors present challenges, they also create unique opportunities. By understanding the nuances, potential buyers might find that now is the perfect time to get their finances together, get a pre-approval, and start house hunting.

Exaggerating the market’s negative aspects can deter potential buyers from exploring their options. While the headlines may be daunting, the reality is more complex. Buyers who educate themselves on current conditions and leverage the available data might discover that there are golden opportunities amidst the perceived chaos.

Interest Rates Outlook

If you’re waiting for interest rates to decrease before starting your house hunt, you might be in for a long wait. The Federal Reserve has been raising interest rates for about two years to combat inflation, and it’s not likely to reverse course soon. Experts predict that any significant rate cuts might not occur until the end of 2024, making it unwise to delay your plans based solely on rate expectations.

Given this outlook, potential buyers should consider acting sooner rather than later. Waiting for lower rates could mean missing out on current opportunities. Instead, focusing on securing a home at a fixed rate now might prove advantageous, especially if future economic conditions remain unpredictable.

Recent Discussions about Interest Rates

Deloitte’s report highlights significant challenges due to high interest rates, particularly regarding the cost of capital and capital availability. About 50% of respondents expect these issues to worsen through 2024. The report emphasizes the need for real estate firms to mitigate expenses, improve technological capabilities, and address environmental, social, and governance (ESG) regulations. Strategies suggested include proactive property portfolio structuring, risk mitigation, and modernizing core technology infrastructures to build a more sustainable and efficient business model.

This outlook discusses the varied performance across different real estate sectors in light of fluctuating interest rates. While multifamily and neighborhood retail sectors are performing well, the industrial sector shows signs of softening. The future of office space remains uncertain, influenced by high vacancy rates and changing work patterns. The report stresses the importance for real estate owners, operators, and investors to optimize cash flow and prepare for opportunities arising from market adjustments due to interest rate changes.

The Forbes Advisor article provides an in-depth analysis of expected trends for mortgage interest rates in the near future. According to the forecast, mortgage rates are anticipated to remain elevated throughout 2024, fluctuating between 7% and 8%. This projection is based on insights from various experts in fields such as economics, finance, and real estate. The article suggests that while rates may peak at around 7.63%, they are expected to decline gradually, potentially falling below 6% by the end of 2025. This trend is influenced by factors such as the Federal Reserve’s monetary policies, inflation control efforts, and overall economic growth. The analysis emphasizes the importance of keeping an eye on these economic indicators to make informed decisions regarding home buying or refinancing.

Housing Market Data

Year-to-date, the number of active listings is comparable to what we saw after the 2008 financial crisis. Additionally, the number of pending transactions during the pandemic was nearly three times the available homes for sale. Today, there are four times more homes available for sale than under contract, providing buyers with more choices and exerting pressure on sellers to price their homes more realistically.

According to US Home Prices and Inventory Trends, Increased inventory means more options for buyers and necessitates realistic pricing from sellers. By understanding these trends, buyers can better navigate the market, recognizing that higher inventory levels often lead to better bargaining positions and potentially lower purchase prices.

This abundance of listings creates a favorable environment for buyers. With more homes available, there’s less competition, and sellers are more likely to negotiate. For buyers ready to move, this can translate into finding a home that fits their needs at a more reasonable price, making now an ideal time to start the search.

Resources about Housing Market Data

The National Housing Market Indicators report by HUD provides a comprehensive monthly analysis of the U.S. housing market, highlighting key statistics such as homeownership rates, foreclosure rates, and overall market activity. The report is an essential tool for understanding the broader economic impacts on the housing market, including policy responses to economic changes and trends in housing demand and supply. The data is vital for policymakers, researchers, and stakeholders to track and respond to market dynamics effectively.

The U.S. House Price Index Report from the Federal Housing Finance Agency (FHFA) provides detailed insights into house price changes across various regions of the United States. The 2024 Q1 report shows a 6.6% increase in house prices from the previous year and a 1.1% rise from the last quarter, offering crucial data for evaluating market trends and economic health. This index is a key resource for real estate professionals, economists, and policymakers in understanding and predicting housing market movements.

The Monthly Residential Construction Report by the U.S. Census Bureau offers vital data on building permits, housing starts, and housing completions. The April 2024 report provides detailed statistics that highlight trends in residential construction, a crucial indicator of housing supply and economic activity. This data helps stakeholders understand the pace and scale of new housing development, which impacts housing availability and prices nationwide.

Pricing Trends

A larger percentage of active listings are priced under $300,000, typically targeted by first-time home buyers and investors. However, in markets like Austin, where flipping houses is becoming less profitable, reduced investor activity is evident. The average flipper in Austin is experiencing a 4% loss, indicating a shift away from investor-heavy transactions towards more opportunities for individual buyers.

Reduced investor activity means fewer competitors for homes, especially in attractive markets like Austin. For first-time home buyers, this could be a prime opportunity to enter the market without the intense bidding wars often seen in investor-heavy scenarios. With more listings available and less investor competition, buyers have a better chance of finding affordable options.

Market Value Challenges

Determining the true market value of a house can be challenging, especially if you’re expecting a major price correction. For instance, a house bought for $260,000 in 2017 might have an appraisal value of $550,000 by 2022. However, when listed in early 2023 at $490,000, it could still be on the market over a year later, with a reduced price of $435,000.

For potential buyers, assessing whether a reduced price reflects actual market value is crucial. While newer houses might offer similar pricing, factors like location and amenities could make older properties more attractive. Buyers need to stay vigilant and informed, ensuring they recognize genuine opportunities amid market corrections.

Five Resources about Assessing Home Values

The Appraisal Institute provides educational resources and standards for professional real estate appraisers. Their methodologies are rooted in rigorous analysis, including the cost approach, income approach, and sales comparison approach, which ensure a comprehensive assessment of a property’s real value.

CoreLogic offers robust property data and analytics, including automated valuation models (AVMs) that are widely used by appraisers, lenders, and real estate professionals. Their AVMs are known for accuracy and comprehensive data integration, providing real value assessments..

The IAAO provides standards, educational programs, and resources for property assessment professionals. Their guidelines cover various valuation methods, including mass appraisal techniques that ensure accurate property value assessments.

The FHFA HPI is a robust tool for understanding house price trends and real values across different markets. It provides insights based on repeat-sales data, making it a reliable resource for assessing real property values

NAR provides valuable resources and insights into the appraisal process, including detailed guides on how professional appraisers determine real property values using comprehensive market data and analysis.

Opportunities for Buyers

Given the current market conditions, it might be a good time for buyers to start their search again. Lower prices and increased inventory present opportunities that weren’t available during the pandemic’s peak. However, the challenge remains to identify homes that offer real value. Location, amenities, and long-term potential are key considerations.

Starting your search now means you might find hidden gems that others overlook. By actively exploring the market, you can identify properties that fit your needs and budget. Don’t wait for the perfect moment; the key is to be proactive and informed, ensuring you make the most of the current opportunities.

Additional Resources

One common mistake that keeps people renting longer than necessary is not recognizing the opportunities available in the housing market. Many renters hesitate due to fear of high prices or interest rates. However, with the right strategies and a proactive approach, transitioning to homeownership can be more achievable than it seems.

About Transitioning from Renting to Home Ownership

This comprehensive guide walks prospective homebuyers through the steps of transitioning from renting to owning a home. It covers essential topics such as saving for a down payment, improving credit scores, choosing the right mortgage, and understanding the home buying process. The guide also offers practical tips on budgeting, evaluating mortgage options, and navigating the complexities of homeownership, ensuring readers are well-prepared for the financial and lifestyle changes involved.

This article provides a thorough overview of the financial and lifestyle shifts that come with buying a home. It details the various costs associated with homeownership, such as mortgage payments, property taxes, and maintenance expenses, contrasting these with renting costs. Additionally, it emphasizes the importance of patience and preparedness throughout the home buying journey and highlights the long-term financial benefits of building equity in a home.

Apartment Therapy’s article breaks down the logistics and costs of moving from renting to homeownership. It explains the timeline of closing on a home, budgeting for moving expenses, and managing mortgage payments. The article also discusses the financial advantages of homeownership, such as building equity, and provides practical tips for a smooth transition, including coordinating move-out and move-in dates to avoid overlapping housing costs.

Staying informed about market trends and expert advice can help potential buyers make more confident decisions. By following these resources, renters can transition to homeowners more smoothly and take advantage of current market opportunities.

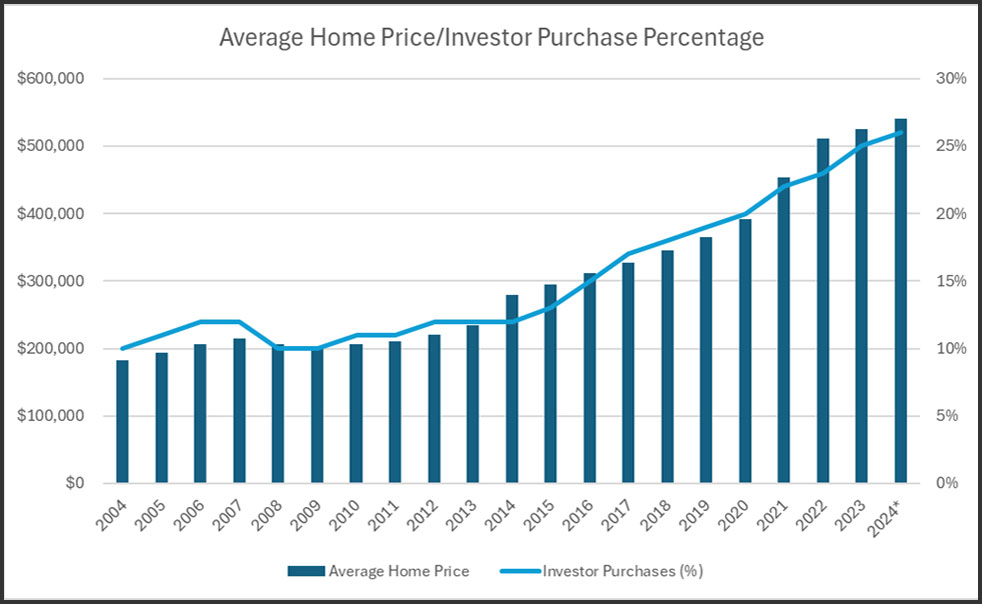

For the Last 20 Years: Home Prices, Annual Price Change, Number of Homes Sold, Investor Purchases (%), and Sources

| Year | Average Home Price | YoY Price Change (%) | Number of Homes Sold | Investor Purchases (%) | Source |

|---|---|---|---|---|---|

| 2004 | $183,000 | 6.2 | 18,500 | 10 | Zillow, Local Market Reports |

| 2005 | $194,000 | 6.0 | 19,000 | 11 | Zillow, Local Market Reports |

| 2006 | $207,000 | 6.7 | 19,500 | 12 | Zillow, Local Market Reports |

| 2007 | $215,000 | 3.9 | 20,000 | 12 | Zillow, Local Market Reports |

| 2008 | $207,000 | -3.7 | 17,000 | 10 | Zillow, Local Market Reports |

| 2009 | $204,000 | -1.4 | 16,000 | 10 | Zillow, Local Market Reports |

| 2010 | $207,000 | 1.5 | 16,500 | 11 | Zillow, Local Market Reports |

| 2011 | $210,000 | 1.4 | 17,000 | 11 | Zillow, Local Market Reports |

| 2012 | $220,000 | 4.8 | 18,000 | 12 | Zillow, Local Market Reports |

| 2013 | $235,000 | 6.8 | 19,000 | 12 | Zillow, Local Market Reports |

| 2014 | $279,000 | 6.5 | 28,000 | 12 | Zillow, Local Market Reports |

| 2015 | $295,000 | 5.7 | 30,000 | 13 | Zillow, Local Market Reports |

| 2016 | $311,000 | 5.4 | 32,000 | 15 | Zillow, Local Market Reports |

| 2017 | $327,000 | 5.1 | 34,000 | 17 | Zillow, Local Market Reports |

| 2018 | $345,000 | 5.5 | 36,000 | 18 | Zillow, Local Market Reports |

| 2019 | $365,000 | 5.8 | 38,000 | 19 | Zillow, Local Market Reports |

| 2020 | $392,000 | 7.4 | 40,000 | 20 | Zillow, Local Market Reports |

| 2021 | $454,000 | 15.8 | 42,000 | 22 | S&P CoreLogic Case-Shiller, Local Market Reports |

| 2022 | $511,000 | 12.6 | 44,000 | 23 | S&P CoreLogic Case-Shiller, Local Market Reports |

| 2023 | $525,000 | 2.7 | 46,000 | 25 | S&P CoreLogic Case-Shiller, Local Market Reports |

| 2024* | $540,000 | 2.9 | 48,000 | 26 | S&P CoreLogic Case-Shiller, Local Market Reports |

For the Last 20 Years: Home Prices, Annual Price Change, Number of Homes Sold, Investor Purchases (%), and Sources

| Year | Average Home Price | YoY Price Change (%) | Number of Homes Sold | Investor Purchases (%) | Source |

|---|---|---|---|---|---|

| 2004 | $183,000 | 6.2 | 18,500 | 10 | Zillow, Local Market Reports |

| 2005 | $194,000 | 6.0 | 19,000 | 11 | Zillow, Local Market Reports |

| 2006 | $207,000 | 6.7 | 19,500 | 12 | Zillow, Local Market Reports |

| 2007 | $215,000 | 3.9 | 20,000 | 12 | Zillow, Local Market Reports |

| 2008 | $207,000 | -3.7 | 17,000 | 10 | Zillow, Local Market Reports |

| 2009 | $204,000 | -1.4 | 16,000 | 10 | Zillow, Local Market Reports |

| 2010 | $207,000 | 1.5 | 16,500 | 11 | Zillow, Local Market Reports |

| 2011 | $210,000 | 1.4 | 17,000 | 11 | Zillow, Local Market Reports |

| 2012 | $220,000 | 4.8 | 18,000 | 12 | Zillow, Local Market Reports |

| 2013 | $235,000 | 6.8 | 19,000 | 12 | Zillow, Local Market Reports |

| 2014 | $279,000 | 6.5 | 28,000 | 12 | Zillow, Local Market Reports |

| 2015 | $295,000 | 5.7 | 30,000 | 13 | Zillow, Local Market Reports |

| 2016 | $311,000 | 5.4 | 32,000 | 15 | Zillow, Local Market Reports |

| 2017 | $327,000 | 5.1 | 34,000 | 17 | Zillow, Local Market Reports |

| 2018 | $345,000 | 5.5 | 36,000 | 18 | Zillow, Local Market Reports |

| 2019 | $365,000 | 5.8 | 38,000 | 19 | Zillow, Local Market Reports |

| 2020 | $392,000 | 7.4 | 40,000 | 20 | Zillow, Local Market Reports |

| 2021 | $454,000 | 15.8 | 42,000 | 22 | S&P CoreLogic Case-Shiller, Local Market Reports |

| 2022 | $511,000 | 12.6 | 44,000 | 23 | S&P CoreLogic Case-Shiller, Local Market Reports |

| 2023 | $525,000 | 2.7 | 46,000 | 25 | S&P CoreLogic Case-Shiller, Local Market Reports |

| 2024* | $540,000 | 2.9 | 48,000 | 26 | S&P CoreLogic Case-Shiller, Local Market Reports |