Key Takeaways

- Historical Perspective on Home Prices: Over the past decades, the median home prices have consistently risen, doubling or more every ten years, despite periodic corrections.

- Affordability is Arbitrary: Perceptions of affordability are often based on median incomes and prices but fail to account for personal wealth and financial resources.

- Impact of Personal Wealth: Many people have significant savings or investments, which drastically changes their ability to afford housing, even if their income alone wouldn’t suffice.

- Market Dynamics and Prosperity: High home prices can reflect a prosperous economy and are often driven by factors like increased construction costs and land scarcity.

- Long-term Investment Value: Real estate remains a solid long-term investment, with historical data showing substantial appreciation over decades.

For decades, the narrative surrounding housing affordability has been overwhelmingly negative. Experts and commentators have repeatedly warned about the unsustainable rise in home prices and the growing divide between those who can afford to buy and those who cannot. However, there’s a compelling argument to be made that unaffordable housing is not necessarily a bad thing. In fact, it can be a reflection of economic prosperity and long-term investment potential. This article explores this counterintuitive perspective, analyzing historical data, market dynamics, and personal wealth factors to provide a comprehensive understanding of why unaffordable housing might be a good thing.

The Historical Rise of Home Prices

For decades, the housing market has witnessed a steady increase in home prices. In the 1980s, the median home price was approximately $63,750. By the 1990s, this figure had doubled to $126,800. This upward trend has continued into the 21st century, with median prices consistently rising, reflecting both inflation and increased demand. Historical data reveals that despite economic downturns, such as the 2008 financial crisis, home prices have rebounded and even surpassed previous highs, showcasing the resilience and long-term value of real estate investments.

This historical perspective on home prices demonstrates that what might seem unaffordable today could be seen as a smart investment in the future. As prices continue to rise, homeowners benefit from significant equity gains. Thus, understanding these long-term trends is crucial for potential buyers and investors who are concerned about current market conditions. It’s essential to recognize that the market operates in cycles, and periods of high prices are often followed by corrections, which then lead to new periods of growth.

The Arbitrary Nature of Housing Affordability

Housing affordability is often perceived through a narrow lens, focusing primarily on median incomes and home prices. However, this perspective can be misleading. Affordability is a relative concept that varies greatly depending on individual financial circumstances. For instance, two people earning the same income may have vastly different levels of affordability based on their savings, investments, and overall financial health. Thus, focusing solely on income and price metrics can provide an incomplete picture of true affordability.

Additionally, the arbitrary nature of housing affordability is influenced by various external factors such as interest rates, government policies, and economic conditions. These factors can significantly impact a person’s ability to purchase a home. For example, lower interest rates can make mortgages more affordable, while government incentives can provide financial assistance to first-time buyers. Therefore, a holistic approach that considers all these variables is necessary to accurately assess housing affordability.

Personal Wealth and Home Buying Power

Personal wealth plays a crucial role in determining an individual’s ability to purchase a home. While income is a significant factor, it is not the only one. Many potential homebuyers have substantial savings or investments that can greatly enhance their buying power. For instance, retirement accounts like IRAs and 401(k)s, which have grown over the years, provide a financial cushion that can be used for down payments or to cover mortgage payments, thereby increasing affordability.

Moreover, personal wealth accumulation through various investment avenues, such as stocks, bonds, and real estate, can also boost one’s home buying power. For example, individuals who invested in tech giants like Apple, Amazon, or even cryptocurrencies like Bitcoin have seen significant returns on their investments. These financial gains can be leveraged to purchase property, highlighting the importance of personal wealth in the home buying process.

Economic Prosperity and High Home Prices

High home prices are often a sign of economic prosperity. They reflect a thriving economy where demand for housing outstrips supply. This demand is driven by various factors, including population growth, increased employment opportunities, and higher disposable incomes. In such an environment, owning property becomes a desirable goal, leading to competitive bidding and higher prices. Consequently, high home prices can be viewed as a positive indicator of economic health and stability.

Furthermore, prosperous economies attract foreign investors who see real estate as a safe and profitable investment. For instance, American real estate is highly sought after by international buyers due to its potential for high returns compared to other countries. This influx of foreign capital contributes to driving up home prices. Thus, high housing prices are not solely a domestic issue but are influenced by global economic dynamics as well.

Real Estate as a Long-term Investment

Real estate is widely regarded as a sound long-term investment. Historical data supports this view, showing that property values generally appreciate over time. For example, a house purchased in 1980 would be worth nearly six times more by 2024, reflecting the enduring value of real estate. This appreciation makes homeownership an attractive option for those looking to build wealth over the long term. Investing in property not only provides a place to live but also serves as a financial asset that can appreciate significantly.

Moreover, real estate investments offer additional benefits such as rental income and tax advantages. Property owners can generate steady cash flow by renting out their homes, while also benefiting from tax deductions on mortgage interest and property taxes. These advantages make real estate a compelling investment choice for those seeking to diversify their portfolios and achieve financial stability.

The Role of Construction Costs in Home Pricing

Construction costs are a major factor influencing home prices. Since the COVID-19 pandemic, these costs have surged by approximately 50%, affecting materials like concrete, gypsum, roofing, and plywood. This increase has made building new homes more expensive, which in turn drives up the prices of both new and existing properties. As construction costs continue to rise, the overall affordability of housing is impacted, creating challenges for potential buyers and developers alike.

Additionally, the construction industry faces a shortage of skilled labor, further exacerbating the issue. With fewer workers available to meet the demand for new housing, construction projects are delayed, and costs increase. This labor shortage, combined with rising material costs, contributes to the overall increase in home prices. Understanding these factors is essential for comprehending the complexities of the housing market and the reasons behind high home prices.

Land Scarcity and Housing Prices

Land scarcity is another critical factor affecting home prices. In many urban areas, the availability of buildable lots is limited, driving up the cost of land. For instance, buildable lots can range from $140,000 to $225,000, significantly contributing to the overall cost of a new home. This scarcity of land forces developers to compete for available plots, further inflating prices and making it difficult to construct affordable housing.

Furthermore, zoning regulations and land use policies can restrict the availability of land for residential development. These regulations often limit the density of housing that can be built, reducing the number of homes that can be constructed on a given plot of land. As a result, the limited supply of housing drives up prices, making homeownership less accessible for many individuals. Addressing land scarcity and revisiting zoning policies are crucial steps toward increasing the availability of affordable housing.

Housing Market Dynamics Over the Decades

The housing market has experienced significant changes over the decades, influenced by various economic, social, and policy factors. In the 1980s and 1990s, median home prices saw substantial increases, driven by factors such as inflation, economic growth, and changes in the mortgage industry. Despite periodic downturns, such as the 2008 financial crisis, the overall trend has been one of rising prices and increased demand for housing.

Understanding these market dynamics is essential for both buyers and investors. By analyzing historical trends, one can gain insights into potential future movements in the housing market. For example, the recovery of home prices after the 2008 crisis demonstrates the resilience of the real estate market and the potential for long-term appreciation. This knowledge can help individuals make informed decisions about when to buy or invest in property.

While unaffordable housing is generally seen as a problem, some experts argue that it can have positive effects under certain conditions.

- Economic Productivity and Density: Increased housing costs often lead to higher urban density, which can significantly boost economic productivity. Studies have shown that doubling a city’s density can raise its economic output by 6% to 28%. This density fosters a more vibrant business environment, supports efficient public transportation systems, and encourages innovation by bringing more people into close proximity (Kenan Institute).

- Real Estate Market Stability: High property values can stabilize real estate markets. When housing is unaffordable, it generally means there is high demand and limited supply. This dynamic can lead to more cautious lending practices and reduce the risk of housing bubbles, which can be economically devastating when they burst (The Zebra).

- Quality Over Quantity: Some economists argue that the focus should be on the quality and location of housing rather than merely its affordability. High housing costs can push urban planners and developers to create more sustainable, efficient, and desirable living spaces. This can lead to better-designed urban areas with improved infrastructure and amenities, ultimately enhancing residents’ quality of life even if housing is more expensive (The New Center).

- Wealth Creation: For homeowners, rising housing prices can lead to significant wealth creation. Homeowners benefit from increased property values, which can provide financial security and opportunities for investment. This wealth effect can also stimulate local economies as homeowners spend more on goods and services (World Economic Forum) (Kenan Institute).

The Misconception of Unaffordable Housing

The idea that housing is unaffordable is often based on a narrow understanding of affordability. While median home prices and incomes are commonly used metrics, they do not account for personal wealth and financial resources. Many individuals have significant savings or investments that enhance their ability to afford a home, even if their income alone would not suffice. Therefore, the perception of unaffordability can be misleading and does not accurately reflect the financial reality for many potential buyers.

Additionally, the concept of unaffordable housing overlooks the long-term investment potential of real estate. Despite high initial costs, homeownership can lead to substantial equity gains over time. Historical data shows that property values generally appreciate, providing financial benefits to homeowners. Thus, what may seem unaffordable today could be a wise investment for the future, underscoring the importance of a comprehensive understanding of housing affordability.

How Wealth Distribution Affects Home Ownership

Wealth distribution plays a significant role in homeownership rates. Individuals with greater financial resources have a higher likelihood of purchasing homes, as they can afford larger down payments and qualify for better mortgage terms. This disparity in wealth distribution can create a divide between those who can afford to buy homes and those who cannot, contributing to the perception of unaffordable housing.

Moreover, intergenerational wealth transfers can significantly impact homeownership rates. Many young buyers receive financial assistance from their parents or grandparents, allowing them to enter the housing market despite high prices. This transfer of wealth helps bridge the affordability gap for some, but it also highlights the importance of personal wealth in the ability to purchase property. Addressing wealth inequality and providing support for low-income households are essential steps toward increasing homeownership rates.

Strategies to Increase Personal Wealth for Home Buying

Increasing personal wealth is a crucial strategy for overcoming housing affordability challenges. One effective approach is to invest in stocks, bonds, or other financial assets that can appreciate over time. For instance, investing in tech companies like Apple, Amazon, or even cryptocurrencies like Bitcoin has provided significant returns for many individuals, enhancing their financial resources and enabling them to afford homes.

Additionally, maximizing contributions to tax-deferred retirement accounts like IRAs and 401(k)s can significantly boost personal wealth. These accounts offer tax advantages and have the potential to grow substantially over the years. By leveraging these financial strategies, individuals can increase their savings and investments, improving their ability to afford a home. Financial education and planning are essential components of this process, helping potential buyers make informed decisions about their financial futures.

The Future of Housing Prices and Market Predictions

Predicting the future of housing prices involves analyzing various economic indicators, market trends, and policy changes. While it is challenging to forecast exact movements, historical data provides valuable insights into potential future trends. For instance, the consistent rise in home prices over the past decades suggests that real estate will continue to be a valuable long-term investment. However, factors such as interest rates, inflation, and government policies can influence short-term market fluctuations.

Experts suggest that the housing market will remain robust, driven by factors like population growth, economic stability, and limited housing supply. While there may be periodic corrections, the overall trend is expected to be upward. Potential buyers and investors should stay informed about market conditions and be prepared for both opportunities and challenges. By understanding the dynamics of the housing market, individuals can make strategic decisions that align with their financial goals.

Conclusion

In conclusion, the perception of unaffordable housing is complex and influenced by various factors such as historical trends, personal wealth, and market dynamics. While high home prices can be challenging for many, they also reflect economic prosperity and the potential for long-term investment gains. By understanding the broader context of housing affordability, individuals can make informed decisions about their financial futures. Ultimately, the key to navigating the housing market lies in increasing personal wealth and leveraging opportunities for growth and investment.

Frequently Asked Questions

Q: Why is unaffordable housing considered a good thing?

Q: How do construction costs impact home prices?

Q: What role does personal wealth play in housing affordability?

Q: How does land scarcity affect housing prices?

Q: What strategies can individuals use to increase their wealth for home buying?

People Also Ask:

- Why is Austin so unaffordable?

- Does Austin have a housing crisis?

- Are housing prices crashing in Austin?

- Which City has the most unaffordable housing?

- Is Austin the richest city in Texas?

- Why is the homeless population so high in Austin?

- Are rents dropping in Austin?

- Is now a bad time to buy a house in Austin?

- Are Austin house prices dropping?

- Will house prices go down in 2024 in Austin?

- Is Austin housing overvalued?

- Is Austin overbuilt?

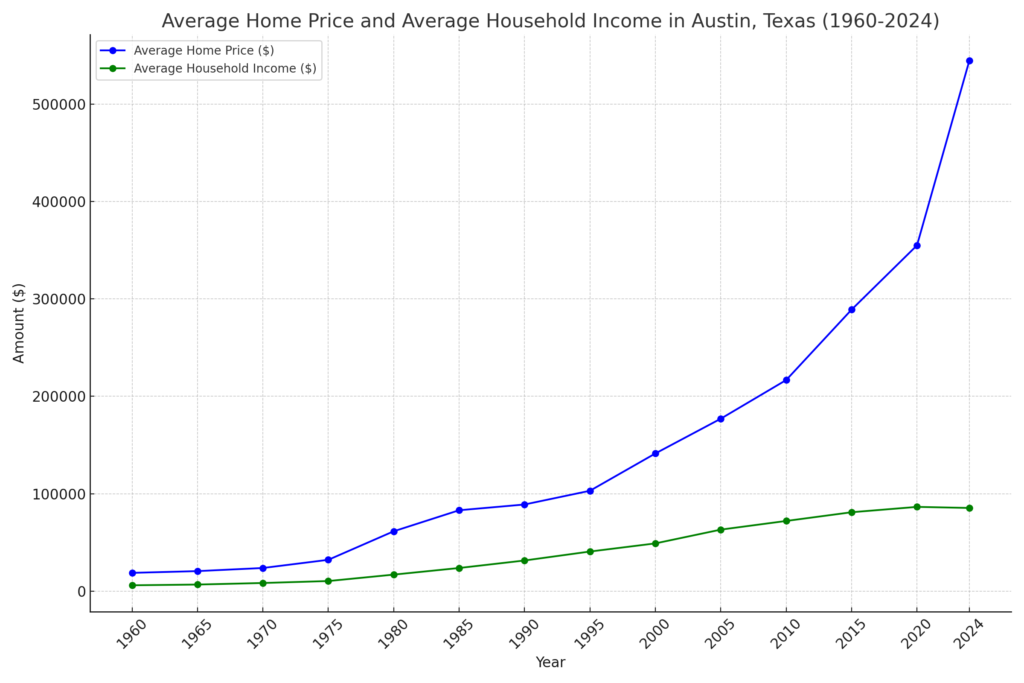

Average home price and average household income in Austin, Texas since 1960

| Year | Average Home Price | Average Household Income |

|---|---|---|

| 1960 | $18,700 | $5,940 |

| 1965 | $20,500 | $6,700 |

| 1970 | $23,700 | $8,300 |

| 1975 | $32,100 | $10,300 |

| 1980 | $61,400 | $16,900 |

| 1985 | $83,000 | $23,700 |

| 1990 | $88,900 | $31,400 |

| 1995 | $103,000 | $40,600 |

| 2000 | $141,300 | $48,950 |

| 2005 | $177,000 | $63,100 |

| 2010 | $216,700 | $72,000 |

| 2015 | $289,000 | $80,950 |

| 2020 | $355,000 | $86,450 |

| 2024 | $544,638 | $85,354 |