Looking ahead, 2020 is projected to be a strong year for homeownership. According to the Freddie Mac Forecast, “We expect rates to remain low, falling to a yearly average of 3.8% in 2020.” If you’re currently renting, 2020 may be a great time to think about making a jump into homeownership while mortgage rates are low. As noted in the National Rent Report, … Read More

It’s ‘National Roof Over Your Head’ Day!

Did you know that each year in the United States, we celebrate “National Roof Over Your Head Day” on December 3rd? As noted on the National Calendar, it was “created as a day to be thankful for what you have, starting with the roof over your head. There are many things that we have that we take for granted and do not … Read More

The True Cost of Not Owning Your Home

There are great advantages to owning a home, yet many people continue to rent. The financial benefits are just some of the reasons why homeownership has been a part of the long-standing American dream. Realtor.com reported that: “Buying remains the more attractive option in the long term – that remains the American dream, and it’s true in many markets where renting has become … Read More

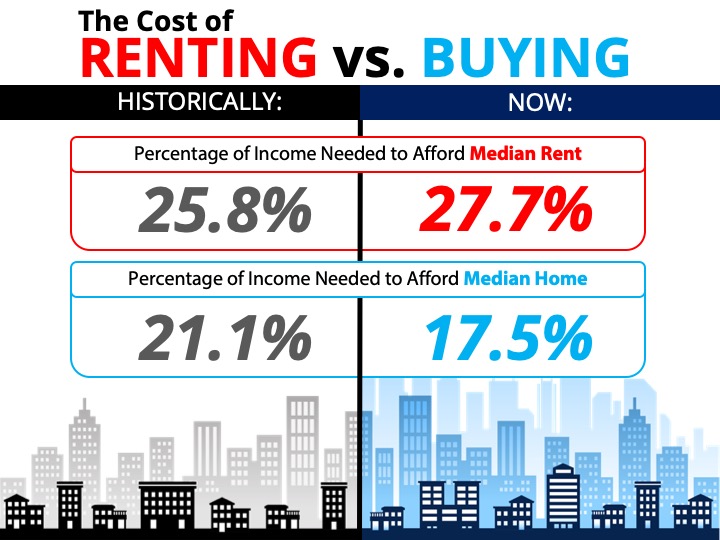

The Cost of Renting vs. Buying a Home [INFOGRAPHIC]

Some Highlights: Historically, the choice between renting and buying a home has been a tough decision. Looking at the percentage of income needed to rent a median-priced home today (27.7%) vs. the percentage needed to buy a median-priced home (17.5%), the choice is clear. Every market is different. Before you renew your lease, find out if you can put your housing costs … Read More

Buying a home can be SCARY…Until you know the FACTS [INFOGRAPHIC]

Some Highlights: Many potential homebuyers believe they need a 20% down payment and a 780 FICO® score to qualify to buy a home. This stops many people from even trying to jump into homeownership! Here are some facts to help take the fear out of the process: 71% of buyers who purchased homes have put down less than 20%. 78.1% … Read More

Think Prices Have Skyrocketed? Look at Rents.

Much has been written about how residential real estate values have increased since the housing market started its recovery in 2012. However, little has been shared about what has taken place with residential rental prices. Let’s shed a little light on this subject. In the most recent Apartment Rent Report, RentCafe explains how rents have continued to increase over the last twelve months … Read More

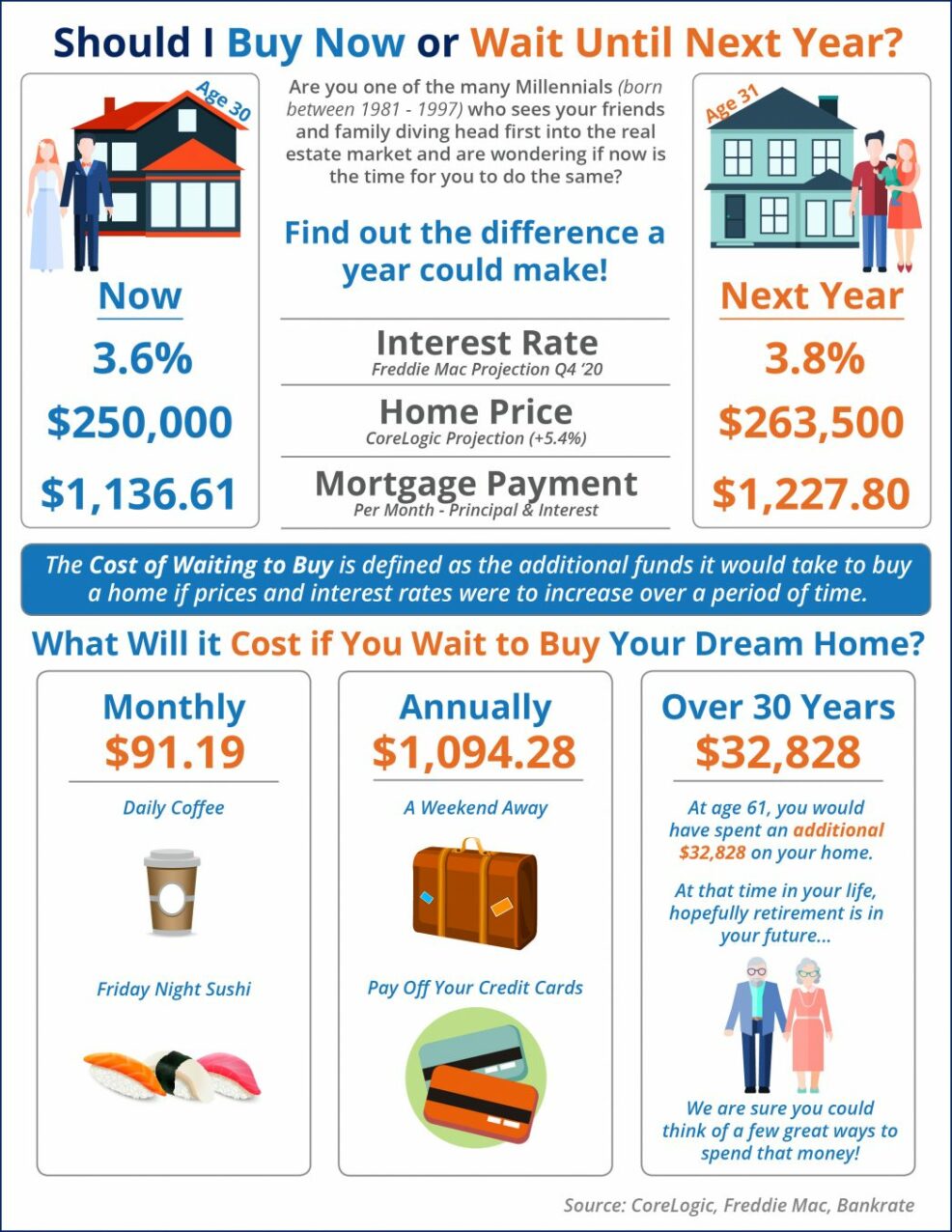

What Is the Cost of Waiting Until Next Year to Buy? [INFOGRAPHIC]

Some Highlights: The “cost of waiting to buy” is defined as the additional funds necessary to buy a home if prices and interest rates were to increase over a period of time. Freddie Mac forecasts interest rates will rise to 3.8% by Q4 2020. CoreLogic predicts home prices will appreciate by 5.4% over the next 12 months. If you’re ready and willing to buy … Read More

Homeowners Are Happy! Renters? Not So Much.

When people talk about homeownership and the American Dream, much of the conversation revolves around the financial benefits of owning a home. However, two recent studies show that the non-financial benefits might be even more valuable. In a recent survey, Bank of America asked homeowners: “Does owning a home make you happier than renting?” 93% of the respondents answered yes, while only 7% said no. … Read More

One of the Top Reasons to Own a Home

One of the benefits of homeownership is that it is a “forced savings plan.” Here’s how it works: You make a mortgage payment each month. Part of that payment is applied to the principal balance of your mortgage. Each month you owe less on the home. The difference between the value of the home and what you owe is called equity. If your … Read More